TIPS on Leadership in Higher Education

Observations, Tools, and Tactics

Edits and forward by: Jack Corby

Support by: John A Stevens of Stevens Strategy, LLC

Contact for Further Information or Questions: mtownsley@stevensstrategy.com or mtown@dca.net.

Table of Contents

ForwardTip #1: Communications

Tip #2: Managing People

Tip #3: Revenue Does Not Equal Cash

Tip #4: The Dangers of Unfunded Tuition Discounts

Tip #5: Limit Authority to Make Cash Purchases

Tip #6: Become a Proficient Public Speaker

Tip #7: Beware of Slush Funds

Tip #8: Small Colleges Should Be Cautious with Large Grants

Tip #9: Review Corporate Documents, Contracts, Operational Policies, and Processes

Tip #10: Learn to Work the Room

Tip #11: Hire Presidents Who Understand Basic Operational Processes

Tip #12: Unity of Command

Tip #13: Manage Time and Energy

Tip #14: Do Not Inundate the Board with Meetings and Material

Tip #15: Allocate Resources to Strengths; Not Weaknesses

Tip #16: Designing a Strong Budget

Tip #17: Leadership and Respect

Tip #18: Forecasts

Tip #19: Cyert Model and Cash Burnout Model

Tip #20: Saving Private Colleges from Financial Failure

Tip #21: Decision Matrix for Colleges in Crisis

Tip #22: How to Manage Transformational Change

Tip #23: Hire the Best Cabinet Officers

Tip #24: Boards of Trustees

Tip #25: Town Gown Relationships

Tip #26: Career Development for Future Presidents

Tip #27: Important Presidential Notes

Tip #28: Be Wary of the Political Model of Governance

Final Note

Tip #1: Communications

The First Tip is that communications must be clear, concise, and coherent in spoken and written communications. What are clear, concise, and coherent communications?- Clarity means that syntax is paramount. Grammatical errors can undermine the meaning of the communications.

- Concise communications focus on one topic and not multiple topics or digress into irrelevant comments or tangents.

- Coherent communications present internally logical arguments.

Tip #2: Managing People

At its core, leadership is the ability to convince the community to accept and support decisions and plans intended to achieve current or long-term goals.Being a college president is never an easy task, and shared governance with the faculty does not make it easier. A pre-condition of management is that the board must affirm the decisions and actions recommended by the president.

Charles Dwyer, an acknowledged scholar of leadership at University of Pennsylvania’s Wharton School, states that leaders, in this case, college leaders, must recognize that individuals place a value on how their work is organized. When a college president plans to change work structures, they will encounter resistance because employees place a value on their contribution to the institution. For change to occur, the president will need to identify the cost to convince an employee to change how they organize their work. That is, leaders must continuously sort out the values of employees to achieve the mission of the college.

Managing people is most contentious when the college faces a financial crisis and must eliminate programs and terminate employees. It is in a financial crisis that the old reliable college leadership tactic of minimizing conflict goes out the window.

The simplest way of describing the Dwyer method is that a president needs to recognize the needs of institutional members. However, as noted above, it may be nearly impossible to serve the needs of all members critical for implementing strategic and operational plans in the middle of a financial crisis. In that case, the president must make it clear that while not all members will be satisfied, those who remain will still have a job. You might find it beneficial to read Charles Dwyer’s book, The Shifting Sources of Power and Influence.

Tip #3: Revenue Does Not Equal Cash

Often, college leaders make the mistake of assuming that revenue equals cash. The differences between the two can have a significant impact on the financial condition of the college.First, revenue is the amount that is recorded in the ledger from a sale. In colleges, the sale is for a seat in a class, and the price is tuition and fees. Most private colleges grant institutional- unfunded scholarships to students. As a result, the student is only responsible for paying the balance. The following table illustrates the transaction.

| Transaction | Amount |

| Tuition & Fee Charge for 4 courses (Revenue) | $53,949 |

| Tuition Discount (56.1% of Tuition & Fees) | 30,265 |

| Net Tuiition & Fees (Student Pays) | $23,684 |

| Tuition & Fees figure is the average for 2024; Research.com | |

Where net tuition drops significantly over time while expenses increase over the same period, colleges will be unable to dig themselves out of their fiscal mess. The paradox is that expenses must be in tune with net tuition revenue to avoid a fiscal disaster. When minimal cash flows into an enrollment- and tuition-dependent college, it is nearly impossible to attain financial viability.

The only solution to this situation is to ensure the college has an outstanding CFO with a supportive business office and the college begins cutting expenses to become cash flow positive.

Tip #4: The Dangers of Unfunded Tuition Discounts

Tuition discounts are the front line of price competition. Given that the pool of high school graduates is shrinking, and more high school graduates are choosing careers not requiring a college degree, colleges are forced into price competition through tuition discounts. The problem with student discounts is that they are phantom sources of revenue and, if mismanaged, can have drastic effects on an institution. They are why audits present net tuition as the bottom line in student tuition revenue: “Tuition revenue minus tuition discounts = net tuition.” Since tuition discounts are unfunded, they reduce the flow of cash from enrollment.In 2023, the National Association of College and University Business Officials (NACUBO) reported that tuition discounts at private colleges rose to 56.1% of tuition for incoming first-year students. In other words, new students only provided 43.9% of tuition revenue in cash. For continuing students, according to NACUBO, the discount rate was 51.9%. As students move forward toward graduation, the average tuition discount rate moves forward with them. The NACUBO report data suggests that the discount rate will continue to increase for new first-year students.

While the 56.1% rate seems high, some colleges have already reached a 70% tuition discount rate. These colleges are only netting thirty cents in cash on a dollar of revenue. It is difficult to understand how these colleges can generate enough cash to support operations.

Then there are colleges that contract with third parties to find new students. These enrollment contractors often charge a 25% rate on new student tuition that they find. For colleges at the 56% discount level, these enrollment contracts shrink net tuition or net cash flow of nineteen cents on the dollar of tuition revenue. These colleges have to be at the brink of a financial crisis.

Enrollment contracts produce a more horrific outcome for the 70% tuition discounters. Under these circumstances the 70% discounters end up having a tuition discount of 95%. In other words, they net five cents on the dollar. A tuition-dependent college cannot survive at this level. It would be surprising that these colleges can survive on a five-cent return on tuition revenue.

When private colleges offer very large tuition discounts, they will be forced to look elsewhere than enrollment to save themselves from financial collapse. Since most of these high tuition discounters are enrollment-dependent, they probably do not have many large donors nor a large enough endowment from which they can draw emergency funds.

Tip #5: Limit Authority to Make Cash Purchases

Colleges that grant broad authority to employees to make cash purchases without prior approval will lose control over spending. This authority often results in individuals and departments signing contracts, buying supplies, or even hiring new employees without prior approval. In most cases, credit cards are the main culprit that spurs massive off the books cash spending.Allowing members of the college to make off-the-cuff purchases throws budgets out of kilter. These unauthorized purchases also drive the business office crazy as they try to reconcile receipts with budget categories. Even worse are supported purchases in which the employee expects to be reimbursed. Unauthorized purchases are a sure sign that the college has lost control of its cash reserves.

These cash purchases are particularly dangerous to a college in a deep financial crisis because the college is carrying liabilities of which they do not know the scale of the problem. The first stage in taking control of purchases is to recall all credit cards; Next, the business office should tell local businesses that a) the college is terminating all credit arrangements with stores and b) the college will not reimburse the store for unauthorized purchases.

Furthermore, the president and the board need to inform the college community that cash purchases without prior approval will no longer be reimbursed. There will be unhappiness when receipts are presented for reimbursement and are rejected. This is when the president and the board need to remain stalwart in their decision to end unauthorized cash purchases.

Tip #6: Become a Proficient Public Speaker

There are three types of public speaking: a formal speech, an extemporaneous speech, and a press conference/public meeting. These three types involve different skills that require training and experience to become proficient. Presidents’ who are uncomfortable with public speaking should develop a coaching plan. For instance, the president could ask for advice from academic departments that offer courses in public speaking. In addition, presidents who are neophytes in public speaking could join a group like Toastmasters International. These meetings provide a regular opportunity to speak without the consequences of failure, and their members give non- threatening feedback on a speech.Press conferences/public meetings usually take place during a period of contention. The best way to prepare for a press conference/public meeting is to hire a good public relations firm with experience in contentious press conferences/public meetings. While the firm will not conduct the press conference, they can rehearse a meeting and ask possible questions from the press or the public. A good public relations firm should also have contacts with the media so they have some idea of the questions that will be asked at the live event. When there are public meetings, the firm should place members around the audience to monitor reactions. After the conference or a meeting, there should be a debriefing to review performance and to develop follow-up plans.

Since public speaking is critical for a successful presidency, it is worth the time, effort, and cost to develop those skills.

Tip #7: Beware of Slush Funds

Typically, slush funds are given by someone outside the college to support an activity of a department or a person within a department. The beneficiaries see these gifts as under their control and outside the oversight of the business office. In other words, the funds can be used at the whim of the employee or department. When slush funds bypass normal college controls, it is not unreasonable to assume that they will serve the personal interests of the recipient and not the interests of the college.The only way to control slush funds is to establish the requirement that all funds received by individuals or departments that do not pass through the normal channels of gift-giving are to be treated as gifts to the college and must be reported to and deposited by the business office. In addition, any use of those funds should follow standard business procedures.

Also, the existence of slush funds and new gifts to those funds should be reported to the board of trustees. They can either affirm or deny their use per college policies. After the board has acted and if the funds used are approved, they can be disbursed. Here are several typical departments that may have slush funds: athletics, student affairs, alumni affairs, specific academic departments, new projects, or even the president’s office. In sum, slush funds are problematic for these reasons:

- Slush funds often distort institutional financial strategy and operational plans.

- If auditors are unaware of these funds, an audit is not a true representation of a college’s finances.

- These funds, when used, may not follow college purchasing procedures.

- Decisions to use these funds by the holders of the money may leave the president uninformed about certain critical aspects of the institution.

- If the slush funds are large enough, they may allow the area controlling these funds to separate themselves from the operations of the college and act as an independent entity.

Tip #8: Small Colleges Should Be Cautious with Large Grants

College presidents at small, financially struggling colleges may see large federal or private grants as a windfall that can save the college. However, large sums of money accompanied by governmental or private grantor regulations can also wreak havoc in a college. Large grants are seductive and potentially undermine college operations and second, boards of small colleges should not approve separate entities that are independent of the college’s operational structure to manage the grant. Separate entities are vulnerable to loss of management and financial control.

Tip #9: Review Corporate Documents, Contracts, Operational Policies and Processes

It is well worth the president’s time to become intimately familiar with all the college’s legal documents. Furthermore, the president must often educate the board on their duties and limits. These legal documents include corporate papers, contracts, operational policies, and processes that delineate the legal structure of the college and the limits of board and presidential action. Corporate papers include the charter, mission statement, and by-laws. Contracts comprise faculty agreements, student matriculation records, and student handbooks. Operational policies and processes cover due processes, work assignments, disciplinary procedures, and other documents that lay out how the college operates.In addition, presidents should become familiar with basic legal terms and concepts to better understand the state and federal legal concepts that govern the college and changes in strategies and plans. One way of familiarizing themselves with the law is to attend seminars on college law. Likewise, they should build a small personal law library with books on contracts, intellectual property rights, and Black’s Law Dictionary.

In times of crisis, these legal commitments become substantial obstacles to change. If ignored until a financial crisis, even small legal challenges can wreck turnaround plans. A prudent recommendation for boards and presidents is to hire competent legal counsel familiar with higher education law. The college attorney should review strategies and operational plans as they are being devised and assist the president in a review of the current legal documents. During a financial crisis, the board and president, with the college’s attorney, should minimize the risk that a could rule against turnaround plans.

Tip #10: Learn to Work the Room

While ‘working the room’ seems like a minor skill, it is essential for presidents who must introduce themselves to the college community and potential donors. Many presidents are uncomfortable meeting strangers, but it is vital for their college to have strangers feel welcome by its leader. The goal should be to go to every table or each person in the room and introduce yourself.The president should arrange to have someone accompany them as they move through the room. This person is like an advance public agent for a politician. The purpose of the public assistant is to whisper in the president’s ear the name of the person, their occupation, and their importance to the college. Obviously, it is crucial to have an assistant who knows people and may even be on a first-name basis with many people in the room.

Formal and informal dinners, community associations, and alumni meetings are typical arenas where ‘working the room.’ This should be done at every public event. Eventually, ‘working the room’ will become second nature to the president. Moreover, this skill will be useful when it comes to running a fundraising campaign or seeking political help for the college.

Tip #11: Hire Presidents Who Understand Basic Operational Processes

Boards of trustees at small colleges need to recognize that their college cannot afford the usual coterie of chief administrators nor afford layers of administrative support staff. In today’s higher education market, small colleges must take to heart that they must operate with administration and staff who can wear many hats and serve in various roles. Even the president needs to be multifunctional. That is, the president may also need to be the chief academic officer and, in some cases, the chief marketing officer.Given the condition that the president must do more than be responsible for classical leadership functions, the board needs to determine if the presidential candidate has the skills to wear other hats if needed, like acting as the chief academic officer and chief marketing officer.

A good president should have experience with academic operations, from scheduling classes, designing curriculum, evaluating faculty, understanding the optimum path to graduation for majors, and linking academic programs to labor markets or graduate/professional schools.

During the hiring process, boards should arrange with a third party to evaluate a presidential candidate’s qualifications, leadership skills, performance aptitude, and psychometric testing. The latter step is to assess if the candidate has the personal skills to deal with conflict and work toward a solution with a small team. The board should also arrange for an in-depth evaluation of prior work experience. The evaluation should contact and interview prior employers and colleagues. This is not an inexpensive process, but it could reduce the chance of hiring someone who cannot do the job.

The board needs to keep in mind that they are hiring a practical, problem-solving president and not a great academic scholar.

Tip #12: Unity of Command

Unity of Command is a simple concept that is hard to accomplish in higher education. Simply, it means that one person has decision authority and is responsible for the employees, the decisions, and actions in a division, a department, a project, or a standard set of tasks. Colleges and universities dilute unity of command by diffusing authority and responsibility across an institution’s departments, divisions, and sectors. This issue is readily evident in the relationship between the faculty and the president regarding academic decisions.Michael Cohen theorized that the diffusion of authority and responsibility is the ambiguities of leadership. In the Mechanisms of Governance, O.O. Williamson said that these ambiguities generate opportunities for members of an organization to exploit for their self-interest. The loss of unity of command often results in self-interested behavior that runs counter to the institution’s goals.

Here are several suggestions on how colleges can minimize the ambiguities of leadership and promote unity of command.

- The Board of Trustees should clearly state that they retain final authority over all decisions.

- The Board should also state that all employees report to the president, not the board of trustees.

- Review and redesign workflows so that a single person oversees a standard set of tasks, such as matriculation, enrollment, financial aid, and graduation flow.

- Assign the head of academic affairs the responsibility to eliminate curriculum overlaps, courses with low enrollment to faculty assignments, and course flows that extend the course needed to meet graduation requirements.

- Establish IT repair and purchase priorities for a single communication site.

- Regularly publish updated tables of organization and eliminate dotted lines and crossed lines of responsibilities.

- Have a directory of job descriptions that lists to who the position reports, the operational goals of the division, the responsibilities of that position, and a schedule of reports to be filed with the chief administrator.

Tip #13 Manage Time and Energy

Money and assets are not the only resources that are scarce in a college. The president and other institutional leaders are subject to the scarcity of their own time and energy. These resources can be easily overwhelmed in a financial crisis or when leaders are excessively involved in every decision, no matter how trivial. Decisions made under duress or fatigue can yield bad decisions. Here are several suggestions to keep energy levels high and retain control over time.- Assign trivial matters to someone else.

- Establish priorities for issues that require a leader’s attention.

- Schedule time for exercise each day. Even a 30-minute walk around campus can assist in managing your energy.

- Set a consistent time to arrive and leave work.

- Try not to bring work home. If you work from home, create physical and mental separation from your work.

- Recharge by taking vacations and visiting friends.

Tip #14: Do Not Inundate the Board with Meetings and Material

Boards of Trustees do not have the time to review piles of material for board meetings. The president should give board and committee members reports or action requests that:- State significant issues,

- Present salient data that frames the issues,

- Succinctly summarizes the connection between the data and issues, and

- Concludes by identifying how the report relates to goals and plans.

Tip #15: Allocate Resources to Strengths; Not Weaknesses

Allocating resources to the college’s strengths sounds simple enough, yet it can be challenging. Colleges tend to continue allocation patterns because current funding patterns are evaluated in terms of productivity, support for the mission, or contribution to financial viability.When allocations, whether operational or capital, are not regularly evaluated, departments will continue to meander even after they have outlived their usefulness. Academic departments are the most complex departments in which to reallocate resources toward strength. They seem to prefer their working ways regardless of the college’s cost and their own future risk that if the college has a financial crisis, they might lose their job.

Misallocations significantly strain colleges facing financial crises, slowing the redirection of funds toward attracting new student markets and hindering potential revenue growth through marketing campaigns. Meanwhile, many marketing departments are spending millions to recruit students, and the high rate of competitor spending can push a college out of the market.

One way to confront misallocations is to annually review each department’s contribution to the college’s financial condition. These reviews are labor-intensive but extremely necessary.

Tip #16: Designing a Strong Budget

Budgets are where strategies and operational plans play out. Incremental budgets can sink new strategies and plans. Furthermore, poorly designed budgets are not good platforms for managing a budget. Here are several suggestions for developing a budget that is a robust management tool.- Budgets for the revenue department should include the department’s budgetary goal, a revenue section, how the revenue is generated, the expenses needed to achieve the revenue goal, the allocation of college administrative support, and the net contribution to the college.

- Instructional departments should show, in detail, their expected enrollment and expenses that encompass the costs of full-time and part-time faculty, support staff, and administrative staff.

- Institutional Advancement budgets should highlight the money to be raised, the cost of administrators and staff, detailed fundraising goals, and the strategy to attain those goals.

- Marketing and Enrollment Management budgets should include their enrollment goals, the cost of administrators and staff, and detailed costs of marketing and advertising plans.

- Academic Support departments should include technology costs, the list of employees and their costs, and the number of students expected to use academic support services.

- Student Services departments should include in detail athletic teams, expenses, and personnel needed to support resident students, a list of student groups, the number of participating students, and the cost of staff supporting the groups. Particular attention should be given to the breakdown of tuition revenue versus student fees allocated to Student Services.

- General administration should list the number and cost of administrators, support staff, and major expenditures in detail, such as insurance.

- Plant and Grounds Departments – besides the list and cost of employees, these breakdowns should also identify the plans for minor and major projects. In addition, this department should indicate how plant and ground operations costs can be reduced or parsed out year over year.

Tip #17: Leadership and Respect

Leaders must respect the community of employees who serve the college because they deliver the services needed to accomplish the mission of the college. Here are several suggestions about respect:- Dress for respect – not like someone who expects to hang around buddies at a lounge.

- Do not tolerate disrespect.

- Publicly acknowledge performance in achieving the goals of the college or an action that is an outstanding contribution to the community. Awards do not necessarily have to involve money.

Tip #18: Forecasts

Colleges that want to reduce the risk of a financial crisis should test budgets and new programs with a forecast of revenue and expenses. Here are several suggestions for making forecasts:- Forecast financial performance for net operational income, net capital expenses, and net operational cash.

- Forecasts should have at least a five-year horizon.

- Every new program, including but not limited to academic, student services, marketing, and plant operations, should have a forecast.

- The forecast should be tested against the Cyert Model and the Burnout Model. See Tip #19 for more information.

- Revenue budgets should compute net tuition price, net student revenue (net tuition price plus auxiliary revenue net of expenses), and cash balances. The Marketing and Enrollment Office should also provide marketing, advertising, and event campaigns with schedules, expected expenses, and enrollment outcomes. In addition, their plans should include personnel compensation and performance goals by position.

- Maintenance and Security budgets should comprise the number of personnel, their compensation, and a list of all maintenance projects and their respective costs.

- Major Capital Projects need to identify total costs, funding sources, capital payments if there are loans, and annual operation and maintenance costs.

- Operational performance should be compared to the forecast during the fiscal year.

Tip #19: Cyert Model and Cash Burnout Model

A college can use two financial models to test and build a financially viable institution.The first is the Cyert Model, used when the college has generated a series of deficits. The model estimates the total funds needed to achieve financial equilibrium.

The second model is the Burnout Predictor Model, which estimates when the college will exhaust its cash reserves. The Burnout Predictor is computed when the college reports negative changes in operations cash and negative changes in operational net assets. The value of the Burnout Model is that it tells the college how much time it has left before it is at a high risk of closing. The burnout time estimates also bound the time left to rectify the conditions that are depleting cash reserves.

Change in Net Assets ___________

+ Credit Lines ___________

+ Loans from Endowment ___________

Total Amount Needed to Reach Equilibrium ___________

Total Operational Cash Reserve (A) ___________

Change in Operations Cash (if negative) (B) ___________

Divide A by B ___________

Tip #20: Saving Private Colleges from Financial Failure

Here are steps boards and presidents can take to stem a downward slide into a major financial crisis due to a depletion of cash reserves.- Identify why cash reserves are being depleted.

- Are banks threatening to call loans due to violation of covenants?

- Stop all non-essential cash purchases.

- Freeze hiring, except for critical positions needed for ongoing operations, like the chief financial officer and the head of marketing.

- If the endowment has a balance, contact the Attorney General to request state approval for a substantial loan on the endowment. If possible, use the proceeds to pay off loans carrying large payments.

- List all unused or under-utilized property that can be sold.

- Concentrate classrooms, faculty, staff, and administration in as few buildings as possible. If the empty buildings cannot be sold, mothball them to save operational and maintenance costs.

- Run a ‘Save the College’ fundraising campaign.

- Eliminate programs or majors with more faculty than students pursuing a major.

- Design new academic programs to generate larger enrollments.

- Control net tuition by ending contracts for enrollment services that charge a hefty fee, as these services reduce cash produced by new students.

- Put construction contracts on hold.

- Hire a reasonable attorney with broad and successful experience in higher education. The attorney will probably be busy defending the college in lawsuits and reviewing any contracts and changes in corporate documents.

- Identify every source of cash, like uncollected receivables, loose cash stored in files, and expensive automobiles that could be replaced with less expensive vehicles. For example, replace safety patrol cars with golf carts.

Tip #21: Decision Matrix for Colleges in Crisis

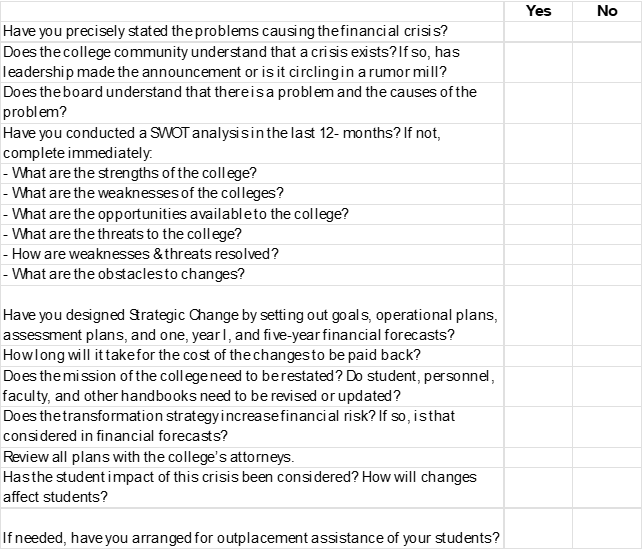

Below is a Decision Matrix to be used by Senior Administrators during a crisis for preparing a recovery plan. This Matrix should be completed individually by each leader and then answered and compared. Any disagreements or lack of understanding should be addressed before planning.

Tip #22: How to Manage Transformational Change

Transformational change usually takes place in response to significant threats to the well-being of a college. There

are

two forms of transformational management – 1) George Keller’s Big Committee Method and 2) The leadership-driven

approach. Below is a brief description of both forms.

Big Committee Transformational Change

The big committee is an excellent approach when the college has the time and funds to carry on the complete cycle of

meetings, reports, forecasts, board reviews, and operational plans. In many cases, the big committee can take

several

years and cost several hundred thousand dollars.

Typically, a consulting firm assists the college and the committee in carrying out their tasks. Consultants will

bring

their own transformational models that will vary depending on the model’s concepts. In times of crisis, the big

committee method may not be the best way to respond to a large-scale crisis, especially a financial crisis.

Leadership-Driven Transformational Change As suggested by name, leadership-driven change is typically run by the president, who works directly and intensively with all sectors of the college community. The purpose of leadership- driven change is to expeditiously move the college toward changes that stem the crisis and implement actions that can preserve the college. Usually, colleges in deep financial crisis will depend on their president or hire an interim president to lead the transformational change. The college should not allow their current president to lead the transformational change because they are the ones who allowed a significant financial crisis on their watch and may have missed critical signs that a crisis was impending. In addition, a president who presided over an impending crisis may lack the skills, vision, or drive to respond to a major crisis effectively.

Therefore, a board should consider hiring an interim leader because the interim can take the heat that large transformational changes will elicit. When the interim leaves, a viable operation should be in place. The next president’s tenure will be calmer, given that the interim did the heavy lifting.

Tip# 23: Hire the Best Cabinet Officers

While a president is key to the success of the college, the cabinet is vital to the president’s success. Here are several tips for building a strong cabinet.- A strong, competent cabinet is a necessity, but they are costly to hire. However, they will be worth the cost if they successfully achieve performance goals while limiting their costs. Furthermore, cabinet officers must be self-confident to make and justify difficult decisions, present decisions to their personnel, and terminate employees.

- The Chief Academic Officer must have the technical skills to do all the jobs performed by the offices reporting to them. In addition, they should have experience and the confidence to manage accreditation relations and new program development.

- The Chief Financial Officer must be a CPA with experience in higher education accounting practices, auditing, debt negotiation, cash investments, chart of accounts redesign, cost analysis, financial problem analysis, and preparing board, presidential, and cabinet reports.

- The Chief Information Officer should have the experience and ability to manage the college’s administrative hardware, lean in and personally execute the administrative system, oversee an IT repair and maintenance team, purchase systems, hardware, and software, manage telephone systems, run academic systems, and is aware of new directions in information technology.

- The Chief Enrollment and Marketing Officer ought to have the experience and ability to design complex marketing campaigns, purchase advertising services, set- up social media campaigns, conduct events, and supervise a soup-to-nuts recruitment operation.

- The Chief Building and Grounds Officer must have experience in supervising custodial, maintenance, and security staff. The officer should also be able to do minor repairs. This officer should also have experience negotiating with security, building, and grounds contractors. Lastly, the chief building and grounds officer should have experience overseeing contractors renovating or putting up buildings.

- The Chief Development Officer must be trained to lead all functions within the advancement or development division. This includes experience in managing major fundraising campaigns, donor relations, and alumni engagement. They should have the strategic ability to expand the college’s philanthropic base, develop new annual and multi-year campaigns, and maintain relationships with major donors. They should be skilled in coordinating with external partners and managing a team responsible for grant writing, gift processing, and donor stewardship.

Tip #24: Boards of Trustees

Boards of Trustees are responsible for ensuring that the college has the resources, tangible and intangible, to achieve its mission. Here are several more suggestions for the board.- The board should be familiar with Roberts Rules of Order or any other document that governs the decision process of meetings.

- They should expect agendas and reports that are clear, cogent, and concise. When they receive materials, they should review them at least twice, coming to meetings ready to guide the institution’s vision.

- Members have a duty to maintain the decorum of meetings. This can be especially challenging during public meetings.

- Members have an obligation to attend meetings so that quorums are met and motions can be passed. If a board member cannot attend meetings, the member should resign so that absences do not adversely affect action.

- Many boards require members to make financial contributions annually to the college.

- Board officers should rotate at regular intervals. It is not good practice to have the same officers in charge for long periods because they can become jaded.

- If the board members and officers are surprised when a severe financial crisis occurs, the officers should be willing to step aside and assist new leaders.

- During a crisis, board members must be prepared for long, frequent meetings. The chair is responsible for keeping meetings moving forward and action taken on resolutions. Any delays can increase the jeopardy of the college.

Tip #25: The town-gown relationship

The town-gown relationship is often fraught with mutual discontent. In the last several years, the primary source of unhappiness for town folk has arisen from political action that either results in boycotts of local businesses or vandalism. It is in the interest of a college’s leaders to minimize discontent and foster mutual understanding. Here are several ways in which colleges can work more amicably with local citizens and government bodies.- Colleges have a valuable service many residents seek – a college education. Artful presidents can arrange an exchange of scholarships and special discount programs for students from the local high school.

- Colleges need debt for renovations, buildings, and improved services. One or several financial institutions can arrange debt financing. The local financial agencies benefit by earning interest. Also, capital projects bring in employees who need bank accounts and spend money at local merchants.

- It is in the interest of the town and the college to protect themselves from marauding groups participating in public drunkenness, hooliganism, and the use of drugs. Moreover, the College should not give the impression to the local community that students and employees can withdraw behind the protective walls of the college when their public behavior violates public laws or commonly accepted public behavior, especially during political unrest. Colleges ought to work closely with local law agencies to maintain tranquility in the community.

- Colleges need to buy goods and services, and it makes sense for the college and for local businesses to work together.

- The college can offer local institutions another valuable service, such as training programs for schools, businesses, government employees, police, and other Training for local institutions

- Colleges can also make available large meeting places that are unavailable otherwise.

- Colleges could partner with the local community to facilitate entrepreneurial and technology incubators for students, graduates, and local leaders.

Tip #26: Career Development for Future Presidents

Anyone interested in becoming a president needs to consider doing the following to become a successful manager of a college with a strong academic reputation that is financially viable.- Enroll in a presidential leadership program that, in addition to the leadership courses, offers instruction in higher education finance and basic economics as well as a networking opportunity.

- Arrange for training in higher education law, basic contracts, intellectual property law, and corporate law.

- Map out personal training in these college offices: business, registrar, marketing, admissions, fundraising, building and grounds, and capital programs.

- Visit successful presidents and ask them for advice on how to become a successful president.

- Sit-in on board meetings.

- Enroll in seminars run by professional associations in higher education.

- Keep a notebook and regularly write summaries about your training, the issues that you have encountered, and concepts where you need more information. Review your notes regularly to ensure you are following your own advice.

Tip #27: Important Presidential Notes

1. Develop the best and most cost-effective programs to attract new students.2. Know your student market and the job market for graduates.

3. Learn how to read accounting statements and audit reports.

4. Review all spending, especially purchases made by cash.

5. Check cash reserves, and when reserves are shrinking, find out the cause.

6. Require cabinet officers to write annual operational goals and plans and schedule time for reviews.

7. Schedule personal visits with all board members, major donors, and alumni clubs.

8. Allocate resources toward strengths, not toward failing programs.

9. Resolve tough personnel decisions fairly and quickly.

10. Provide evidence to the board of trustees that the college has the resources to achieve its mission.

11. Understand the ramifications of corporate by-laws, the college’s mission, past and current board resolutions, faculty contracts, faculty and student handbooks, and all process statements used in operations that the Chief Administrative Officer oversees.

12. One rule that small private college presidents should always follow: Minimize Debt.

Tip #28: Be Wary of the Political Model of Governance

John A. Stevens and Michael Townsley A political model used to govern private colleges and universities goes back centuries in higher education. Its origins may flow directly from the scholars of medieval colleges onwards and have been expressed in C.P. Snow’s novel, The Masters, about the election of a new master at Cambridge University. J. V. Baldridge moved the discussion of the effect of political decision- making in his political model of governance described in his book Models of University Governance. M.D. Cohen’s and J.G. March’s Leadership and Ambiguity introduced the concept that ambiguities in the structure of the governance of higher education muddle decision-making and make it susceptible to classic political maneuvering that dilutes or obstructs the intentions of college presidents.In essence, the political model suggests that a decision about institutional allocation of resources can only achieved by building a coalition of supporters. Dwyer’s book, The Shifting Sources of Power and Influence, posits that a leader must account for and serve the needs of players who are critical to support the decision. Simply – a good leader is also a good politician.

The Baldridge, Cohen and March, and Dwyer models imply that, like successful political votes in Congress, support for policy changes will require a political coalition and a revision of the proposed policy. The bargaining that necessarily must be part of building a political alliance has the potential of distorting the outcome in a way that mitigates its value to the institution and may even prove to contradict an institution’s mission and the implied duties of the leader to serve the interest of the institution.

In other words, the political model must not subsume or undermine the institution’s mission and its duty to maintain a sound governance system. For instance, political coalitions can undermine the proper delegation of authority, rigorous financial management and decision-making, and development and adherence to well-considered institutional policies. Political appeasement must never be allowed to hinder responsible practice. Fear of conflict is the surest cause of conflict.