Michael Townsley, Ph.D.

March 31, 2024

Introduction

For the past decade, our colleagues and columnists have remorsefully muttered about friends in terminally ill colleges. Now, we know “for whom the bell tolls.” As more old colleges are thrown on the death cart, other small colleges only wait and wonder if their college is next to be chucked on the heap of history.

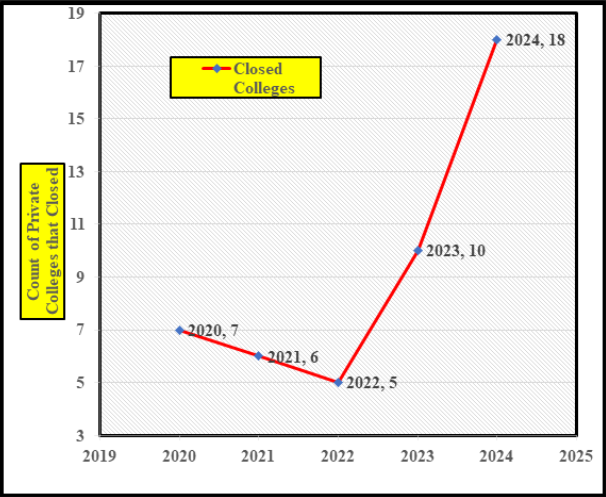

College closings have accelerated since 2022 despite the large influx of federal funds in 2022 (see Chart 1). What is particularly troubling for 2024 is eighteen colleges have announced that they are closing or closed in just the first three months. This is twice the average for the previous four years. If that trend continues, seventy-two private colleges could close by December 2024.

Chart 1[1]

Count of Private Colleges and Universities that Closed between 2020 and March 2024

Seemingly, COVID funding may have masked financial problems that reappeared as the funds were depleted. Here are several problems, given current conditions in the private higher education market that could have an adverse effect on the financial vulnerability of a college:

- Long-term decline in births and by extension smaller high school graduation classes.

- There is no single demographic on the horizon that can provide a large number of new students as there were starting in the 1980s, when women either returned to finish a degree or working women saw opportunities that a degree would provide.

- When the pool of buyers shrinks, economics posit that prices will decline and either demand will increase or supply will decline, thus colleges will close. Prices, in this case tuition, are cut by increasing the tuition-discount rate. NACUBO (National Association of College and University Business Officials) reported that in 2023 the discount rate was 56.2%.[2] As discounts rise, tuition produces less cash, which reduces the amount available for expenses. Tuition discount increases coupled with less cash from tuition is worrisome for tuition-dependent colleges and universities. Because the average discount rate was 56.2% in 2023, the average private college received ess than 50 cents on the dollar from tuition revenue. Several news items note several colleges are offering discounts up to 65% of tuition (this rate does not include discount rates offered by highly selective colleges and universities).[3]

- Some colleges continue to retain academic programs with too few students and too many faculty and staff, while other colleges are eliminating programs to reduce costs. (See this reference: “How US Colleges Are Responding to Declining Enrollment”.[4]

- Colleges are expected by governmental regulators to moderate rates of attrition, Therefore, low academic skills of entering students force colleges to expand academic support services at significant cost to minimize attrition. (See these references for articles about skill: “Student achievement gaps and the pandemic”[5]; “The pandemic has had devastating impacts on learning”[6]; “Math Skills Fell in Nearly Every State”[7] “High School Students Think that They are Ready for College, But They Aren’t”[8]

- Owing to declining enrollment, some colleges carry empty rooms and buildings on their books Although these rooms and buildings are not used, they still drain resources as they need custodial care and regular maintenance, otherwise the unused building could become a safety hazard.

- Maintaining and operating out-of-date IT equipment and software reduces the capability of a college to serve its students, manage its finances, and efficiently run academic and administrative software. Since these colleges may not have the resources or the good fortune to receive grants or gifts for new IT technology, they will lag behind better-funded competition and be less attractive to new students.

Vulnerability Gauge – Predicting Financial Risk

This paper introduces a Vulnerability Gauge to predict if a private college or university is or is not at risk of financial failure. A logit regression tested the model with several different combination of variables. The model was applied to a random sample of forty-four private colleges and universities drawn from the Integrated Postsecondary Education Data System[9] (IPEDS). database. The tests found the most robust and parsimonious model had an 86.3% prediction rate of financial risk when these two factors were used:

- Annual percentage change in unrestricted net assets over five-years (for most private colleges, these assets represent the ready financial reserves that cover operational expenses);

- The total change in FTE (full-time enrollment) over five-years.

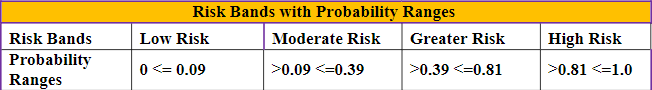

The logit regression yielded probability of financial failure for each school in the sample. The probabilities were then arrayed into four risk bands: low, moderate, greater, and high risk of financial failure as shown in Table 1. The risk bands indicate that the lower the probability, the lower the risk of closing and the higher the probability, the greater the risk of closing.

Table 1

Risk Bands of Probabilities for Study Sample

Findings from Large Sample Analysis of Unrestricted Net Assets and Enrollment

After the random sample was tested, the model was then employed to test the vulnerability of 949 private colleges that were open in 2016. This sample excluded medical schools, research institutes, arts programs, seminaries, and other specialty colleges. The analysis covered the period 2016-17 to 2021-22, which was the most recent year in which IPEDS higher education data was available.

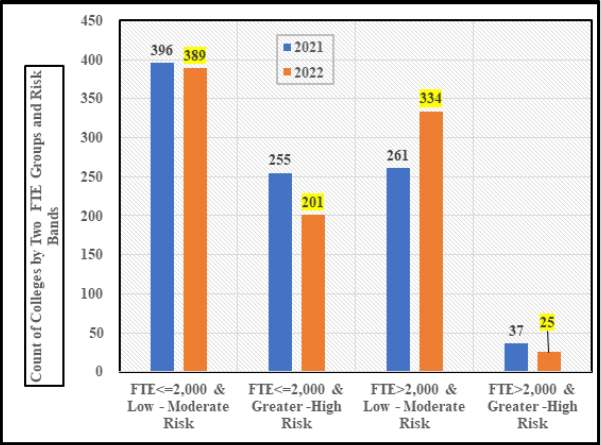

Chart 2

Colleges Assigned to Two Classes of Risk and Enrollment for 2021 and 2022

Chart 2 compares colleges based on their risk band and enrollment (FTE) for the years 2021 and 2022. Two major variables are displayed in the Chart – FTE enrollment and Risk Bands, which are described in Table 1. The FTE is divided into two categories of colleges, FTE with less than or equal to 2,000 students and FTE with more than 2,000. The second variable merges Risk Bands. The first risk band includes colleges with low to moderate Vulnerability Guage scores of ‘0 to less than 0.39’ and the second includes colleges with greater to high-risk scores greater than 0.39 to 1.0.

Here are several observations from Charts 2:

- In 2021, 255 private colleges with less than or equal to 2,000 students were rated at greater to high risk, but only 37 colleges with more than 2,000 students were rated with the same risk. In other words, institutional size seems to be a major factor in determining risk. In 2021, the risk rating for small colleges was 6.9 times greater than for larger colleges.

- In 2022, 201 more smaller colleges than larger rated as greater to high risk, 54 fewer colleges than in 2021. Yet, the greater to high-risk rating for smaller colleges was 8.0 times larger than larger colleges.

- In 2022, the enrollment group with more than 2,000 students saw seventy-three more colleges rated as low to moderate risk, in comparison to 2021, but this group had twelve fewer colleges rated as higher to greater risk.

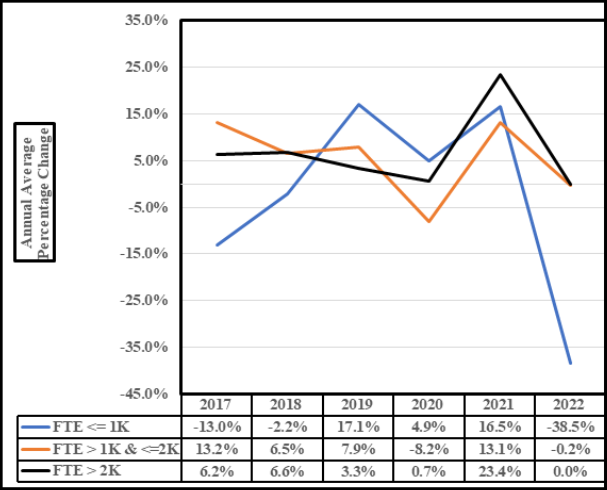

Chart 3 includes the same enrollment and risk groups as in Chart 2, but includes the average percentage change in unrestricted net assets for the years in the 2016-17 to 2021-22 period.

Chart 3

Average Percentage Change in Unrestricted Net Assets for Colleges Rated as Low, Moderate, and Greater Risk from 2016-17 to 2021-22

What is interesting about this chart is the instability from year to year in unrestricted net assets, some years rising and others falling . When unrestricted net assets fall into negative percentage changes, it usually means the college is reporting deficits for the year. For private colleges with small endowments, serial deficits could threaten the financial survival of the college.

Chart 3 indicates that the full effect of federal pandemic funds did not appear until 2021, when each enrollment group in our study had an increase in unrestricted net assets Nonetheless, in 2022, the three enrollment groups experienced sharp declines in unrestricted net assets, and small colleges had the largest decline (-38.5%).

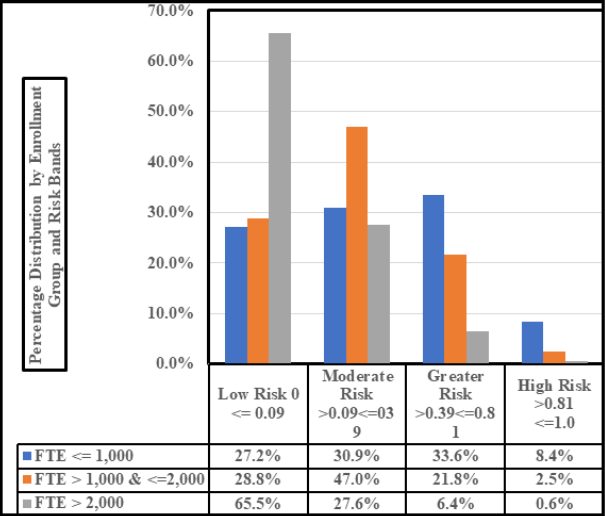

Chart 4 presents a different look at the distribution of colleges by enrollment group and risk bands. It confirms that risk follows scale of enrollment with small colleges facing the most risk of financial failure. According to IPEDS data, small colleges rated as greater to high risk have on average enrollment of 1,200 students.[10]

Chart 4

Distribution of Colleges in Research Set by Enrollment (FTE) Groups and Risk Bands

The relationship of size and vulnerability for private colleges and universities should not come as a surprise, because most private colleges are tuition dependent. Small tuition dependent colleges are especially vulnerable. There are several issues that make the economics and finances of small colleges problematic:

- Recall this quote from Ernest Hemingway’s masterpiece, The Sun Also Rises, “How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually and then suddenly.” Small colleges often lack the financial flexibility when price competition is intense (i.e., tuition discounts, as reported by NABUBO[11] studies), leading to smaller and smaller yields from tuition enrollment.

- Breakeven price rises owing to accreditation, governmental requirements, and student expectations[12] tend to increase fixed costs, which will increase breakeven prices due to the small number of students available to cover fixed costs. The chief financial officer and marketing office must then increase tuition discounts to remain competitive. Here is where the dilemma arises for the chief financial officers at tuition dependent colleges: Rising tuition discounts diminishes the flow of cash from tuition revenue. Less cash from tuition means that there may be insufficient cash to cover expenses. Under this predicament, these colleges lose twice – they have insufficient net revenue to cover expenses leading to a deficit, and cash reserves shrink because cash flow from revenue does not replenish reserves. As noted above, serial deficits can run the college into the ground.

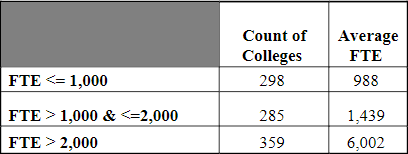

Table 2[13]

Number of Colleges and Average FTE for Each Enrollment Group

Conditions Unique to Higher Education that Degrade Response to Risk

Before any remedy can be prescribed, we need to understand why so many private colleges are slow to respond to economic and financial threats to their existence. The list at the start of this paper identified several factors that shape financial stress, but there are further internal and operational issues that also shape the financial vulnerability at small private colleges.[14] See the following list of issues that may foster financial stress.

- Contradictions of dual governance, where major academic financial problems, and their solutions may be stymied by conflict between the manner in which faculty and administrative govern their respective areas.

- Faculty tenure that places costs, sometimes substantial, for the dismissal of faculty due to a major reorganization and the termination of academic majors or programs.

- Explicit and implied contracts with students, faculty, and external partiesin student handbooks that sets out the liability to students when programs, athletic programs student services, or dormitories are ended or downsized, faculty handbooks that specifiy work conditions, alumni traditions that carry costs, or unstated relationships with local governments that have inherent costs.

- Accreditation and governmental regulations that may stipulate financial conditions to sustain operations and standards for academic programs and student services that can a) raise the cost of operations and b) make it difficult to change academic programs. Governmental regulations can also stipulate financial conditions and standards for maintaining eligibility for federal funds or for compliance with federal mandates.

- State Non-Compete Regulations can keep a college from offering a new program if another institution already offers it.

- Human Capital, buildings and equipment may not match what a college needs during a strategic reorganization to better serve its student market while reducing costs.

Besides the preceding organizational failures, leadership failures by the president and board of trustees shape a private college’s capacity to rapidly respond to financial crisis and building financial vulnerability –. For the last ten years, top leadership at fiscally and operationally stressed private colleges have unintentionally exacerbated problems until a college collapses and closes. Salient characteristics of the leadership failures include:

Presidents

- Risk aversion, when dealing with fundamental changes in student and job markets;

- Tendency to substitute platitudes for real hard-nosed planning

- Not understanding that there are no new student markets, as there were in the eighties and nineties, when women and minorities enrolled in ever-larger numbers;

- Not recognizing that time is short for action and resources are quickly being depleted by every passing day.

Boards of Trustees

- Trustees may not invest either the time or energy to understand the perilous condition of their institution.

- Trustees, in some instances, may not have policy-making or management experience.

- Trustees may be unwilling to challenge claims made by the administration that all is well despite contradictory and obvious evidence.

- Trustees too often do not take the financial problems of the institution seriously until they like the president discover that the college has too few resources and very little time left.

- The Board may not fully appreciate its culpability for failing to oversee and preserve the resources of the institutions for future generations of students.

Potential Remedies for Reducing Financial Risk

Responding to the highest level of financial risk first requires information that delineates the financial, operational, and market conditions of the institution. Before diving into strategic and operational turnaround strategy, the president and board need to acknowledge whether or not operational deficits have become a recurring and increasing threat. In the next step, both the board and president need to know the level of financial reserves currently available, whether those reserves are expanding or shrinking, and how long those reserves will last, if there are operational deficits.

After the board and president fully agree that the college is at risk of financial failure, the board should arrange for a third party to evaluate the college’s – financial condition, in particular, cash flow; academic program contribution to financial performance; the connection between labor markets and academic programs; and the expectation of the student market. There is no surer sign of performance inefficiency than a major with three or more full-time faculty instructing four students in a major.

It is imperative for recognize that Boards need to support Presidents who lead with fortitude, intelligence, and foresight, otherwise it will be difficult for the institution to withstand conflict generated by internal and external dissension in response to major strategic changes. Conflicting solutions and dissension could become a regular event. Nonetheless, every day lost, before taking steps to overcome the inertia toward failure, will push the college closer to its demise.

Since time is of the essence, the board and its president must press-on with dispatch the president, faculty, staff, and administration moving forward while not letting precious time be excessively expended on internal politics and lack of follow-through. Of paramount importance in a survival turnaround is never losing a marketing season for new students. If that happens, the college could lose a year out of the precious short-time available to avoid financial failure.

The factors that make-up the Vulnerability Gauge can guide the development of an effective strategy to generate larger and positive net incomes that increase unrestricted net assets. Focusing on factors in the Vulnerability Gauge will lead to optimizing markets, generating higher cash flows from tuition, cutting administrative expenses, improving the financial and operational relationship between faculty and students, imposing controls on the operational efficiency of capital investments in grounds, buildings and equipment, and moving revenue generating centers toward positive contributions to the bottom line.

For colleges that have arrived at the brink of survival, there seem to be three strategic options that colleges at the brink of extinction consider:

- Merger

- Forming a partnership;

- Looking for wealthy alumni or local donors.

Usually, none of these three strategies are successful. The main reason is that colleges in dire straits have nothing to offer but debt, large financial liabilities, tenured faculty, unusable assets, law suits, and unhappy students and alumni. For the college being petitioned to help failing college, the best option may be to let it fail and pick up the pieces at a discount. The sad aspect of the current spate of college closings is that the causes for a particular institution may be beyond the control of its leaders. Over the next decade, private colleges and universities may operate in a different form and serve student markets with different characteristics, expectations, and capabilities.

Summary of the Main Points about the Vulnerability Gauge

The Vulnerability Gauge was developed as a tool for presidents, boards of trustees, and other interested parties to estimate the risk of financial failure for a private college.

- As noted above, colleges with enrollments of 2,000 or fewer students operate at a greater to highest level of risk. As is evident from news reports over the past several years, this group is shedding the most colleges. Small colleges have difficulty sustaining operations in a high-risk environment.

- The main issues threatening the survival of small, high-risk private colleges are: a shrinking pool of new students, the inflationary costs of operations, ever more stringent governmental regulations, and the loss of confidence by a growing number of high school graduates that a college degree may not be worth the cost.

- The Vulnerability Guage predicts the level of risk that a private college faces. It estimates financial risk using FTE enrollment and the change in unrestricted net assets. It also offers strategic entry points through the factors that are part of Guage.

- For the 201 small colleges living on the brink of survival, there is no timeto dawdle, action must be taken swiftly.

Reference

-

Higher Ed Dive Team ( March 11, 2024), “How many colleges and universities have closed since 2016”; Higher Ed Dive; How many colleges and universities have closed since 2016? | Higher Ed Dive. ↑

-

Moody, Josh (April 25, 2023); “Tuition Discount Rates Reach New High”; Inside Higher Education; NACUBO study finds tuition discount rates at all-time high (insidehighered.com). ↑

-

Some Colleges that Offer the Biggest Discount Rate; NICHE; (Retrieved March 26, 2023); Colleges That Offer the Biggest Discount – Niche Blog. ↑

-

Downes, Lindsey, editor (July 28, 2023) (Retrieved March 27, 2024); “How US Colleges Are Responding to Declining Enrollment”; WCET Frontiers; How U.S. Colleges and Universities are Responding to Declining Enrollments – WCET (wiche.edu). ↑

-

Student achievement gaps and the pandemic (Retrieved March 27, 2024); (Retrieved March 27, 2022); CRPE Reinventing Public Education; ED622905.pdf. ↑

-

Kuhfield, Megan, Jim Soland, Karyn Lewis, and Emily Morton (March 3, 2022) (Retrieved March 25, 2024): The pandemic has had devastating impacts on learning”; Brookings; The pandemic has had devastating impacts on learning. What will it take to help students catch up? | Brookings. ↑

-

Mervosh, Sarah and Ashley Wu (October 24, 2022) (Retrieved March 27, 2024); “Math Scores Fell in Nearly Every State and Reading Dipped on National Exam”; New York Times; Math Scores Fell in Nearly Every State, and Reading Dipped on National Exam – The New York Times (nytimes.com). ↑

-

Heubeck, Elizabeth (February 21, 2024); (Retrieved March 27, 2024); “High School Students Think that They are Ready for College, But They Aren’t”; Education Week; High School Students Think They Are Ready for College. But They Aren’t (edweek.org). ↑

-

IPEDS is a data collection program in US Department of Education’s National Center for Education Statistics. ↑

-

IPEDS (Retrieved March 1, 2024); Complete Data Files; IPEDS Data Center. ↑

-

National Association of College and University Business Officials ↑

-

Breakeven price equals fixed costs (any costs that has to be paid and does not vary with enrollment) divided by variable costs (these costs change with enrollment. ↑

-

IPEDS (Retrieved March 1, 2024); Complete Data Files; IPEDS Data Center ↑

-

A fuller discussion of these factors is available in Colleges in Crisis published in 2021 by Gatekeeper Press. ↑