Private colleges and universities are encountering unprecedented levels of financial stress that may even exceed the financial problems caused by the Great Depression in the 1930s. According to the Hechinger Report article in April 2024, “colleges are closing at a pace of one a week.[1] Sustainability for many colleges means whether they can survive the immediate financial stresses. “Fitch ratings estimated that 20-25 schools will close annually going forward.”[2] However, as of August 2024, thirty-three colleges have already closed which is well beyond the Fitch forecast.

The main financial problem for many private colleges is the continuing decline of average Unrestricted Net Assets. These assets are used for payrolls, other operational expenses, and debt service. After a small increase in the in average assets in 2018, they began a steady decline in 2019 until they hit their lowest level in the chart in 2020. The culprit for reaching the lowest average of Unrestricted Net Assets in 2020 can be traced to the COVID pandemic, when colleges had to close. Despite, COVID’S devastating effect on these assets in 2020, they came roaring back in 2021, when large governmental (federal and state) funds arrived to save the day. Nevertheless, average Unrestricted Net Assets collapsed in 2022 with their value nearly returning to the 2021 COVID level. As Bloomberg reported in 2023, “…government aid during the pandemic helped as a Band-Aid on the long-simmering issue of dwindling enrollments, the expiration of relieve(sp) next year (2024) is likely to expose that a reckoning is already playing out at dozens of colleges.”[3] Sad to say, the chickens are coming home to roost.

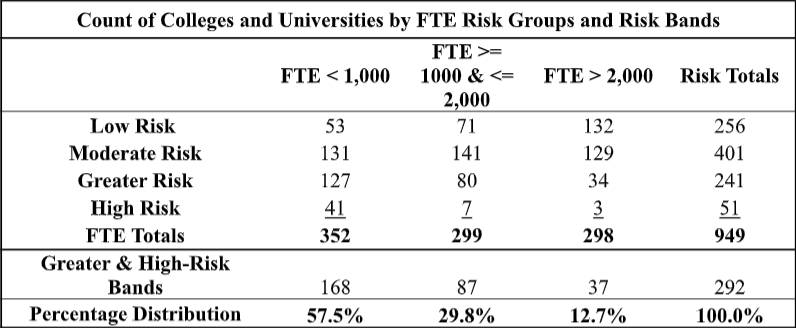

The Vulnerability Guage©, which predicts financial failure was applied to a data set of 949 private colleges, to predict financial risk for three FTE enrollment groups and four risk bands. Table 1 shows that the distribution of colleges by each enrollment group is nearly equal with 37% in the smallest group, 32% in the middle group, and 31% in largest group. However, financial risk as measured by the ‘Greater Risk and High-Risk Bands’ are not equally distributed. Private colleges with enrollments less than 1,000 FTE students were assigned to the ‘Greater and High-Risk Bands’. The next two enrollment groups, FTE 1,000 to less than 2,000 and FTE greater than ,000 FTE respectively had 29.8% and 12.7% assigned to the ‘Geater and High-Risk Bands’. To recap, colleges with enrollments less than 1,000 FTE students face the greatest risk of financial failure.

The following chart shows more clearly the relationship of enrollment and financial risk.

Because many private colleges have felt the full-force of falling enrollment, they can no longer count on tuition revenue to generate the net revenue or cash to support operations and capital expenses. The next chart illustrates what has happened to net tuition since 2016. Although the last year of the chart is 2021, it is probably a fair assumption that net tuition has not increased given that NACUBO reported average tuition discount for private colleges was 56.1%. This was 2% higher than in 2021. Larger discounts mean less cash.

Final Comments

Higher education, in general, and private colleges and universities, in particular, faces a woeful future as slackening demand, rising costs, and excess supply of seats grinds down their financial stability. In most cases, catastrophic conditions did not suddenly appear. They have been present, since student market demographics began their downhill slide at the start of this century. (See the Bloomberg essay, “The Economics of Small US Colleges Are Faltering”)[4]

The preceding discussion suggests that only small colleges are in danger. This is a false assumption because even some medium and large private institutions are rated as high risk. Moreover, with declining enrollment medium and large institutions can slide into the small college column and be subject to higher financial risk

Final comment: Time is of the essence; delaying action does not diminish the factors shaping financial risk for a specific private college or university.

References

-

Marcus, Jon (April 26, 2024); “Colleges are now closing at a pace of one a week”; (Retrieved April 30, 2024); The Hechinger Report; Colleges are now closing at a pace of one a week. What happens to the students? – The Hechinger Report. ↑

-

Querolo, Nic (December 13, 2023); “The Economics of Small US Colleges Are Faltering; (Retrieved April 30, 2024); Bloomberg; US Small Colleges Battered by High Costs, Enrollment Declines (bloomberg.com). ↑

-

Querolo, Nic (December 13, 2023); “The Economics of Small US Colleges Are Faltering; (Retrieved April 30, 2024); Bloomberg; US Small Colleges Battered by High Costs, Enrollment Declines (bloomberg.com) ↑

-

Querolo, Nic (December 13, 2023); “The Economics of Small US Colleges Are Faltering; (Retrieved April 30, 2024); Bloomberg; US Small Colleges Battered by High Costs, Enrollment Declines (bloomberg.com). ↑