Michael Townsley, Ph.D. Senior Associate Stevens Strategy

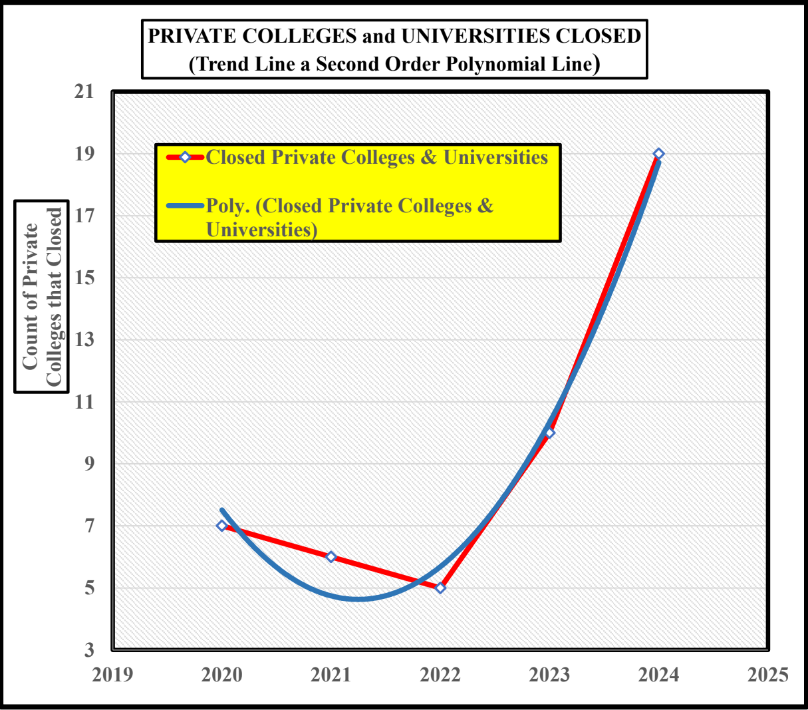

Private colleges and universities are encountering unprecedented levels of financial stress that may even exceed the financial problems caused by the Great Depression in the 1930s. According to the Hechinger Report article in April 2024, “colleges are closing at a pace of one a week. [1] Sustainability for many colleges means whether they can survive the immediate financial stresses. “Fitch ratings estimated that 20-25 schools will close annually going forward.”[2] The curve in Chart I shows the exponential acceleration of closings by private colleges in the first four months of 2024. If this pace continues through this year, there is a possibility that sixty private colleges could close.

Chart 1

PRIVATE COLLEGES and UNIVERSITIES CLOSED

(Trend Line a Second Order Polynomial Line)

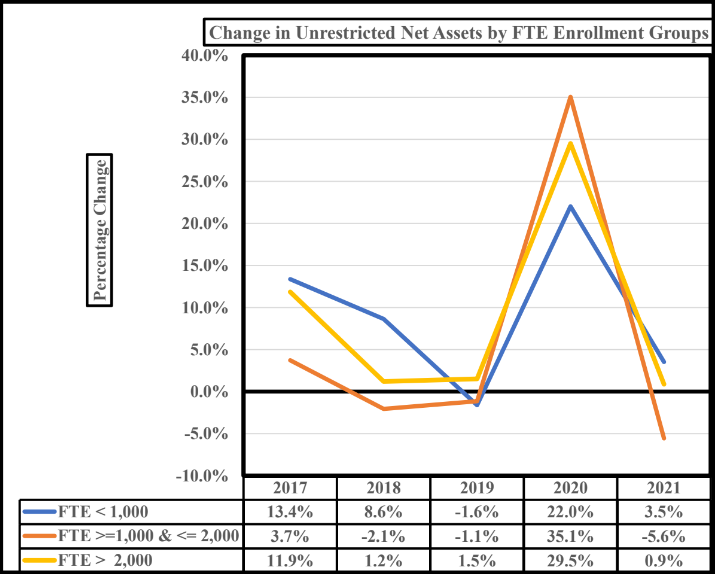

Colleges in two enrollment group in Chart 2 reported outflows of funds from unrestricted assets between 2018 and 2021. The middle FTE group of colleges with enrollments between 1,000 and 2,000 FTE students had the largest number of average unrestricted asset outflows (2018, 2019, and 2021) over the five years of the chart. These colleges in 2020, also, had the largest average inflow of pandemic funds. Nevertheless, as noted these colleges returned to negative outflows in 2021. It is interesting that private colleges in the smallest enrollment group (less than 1,000 FTE students) only dipped into unrestricted assets in 2019. On the other hand, only colleges in the largest enrollment group (greater than 2,000 FTE students) did not have fund outflows from unrestricted net assets. As Bloomberg reported in 2023, “…government aid during the pandemic helped as a Band-Aid on the long-simmering issue of dwindling enrollments, the expiration of relief [in (2024] is likely to expose …reckoning [for] dozens of colleges.” [3] Sad to say, the chickens appear to be coming home to roost.

Percentage Change

Chart 2

In order to answer why colleges are closing and exhibiting greater financial instability, this study used a Vulnerability Gauge© to predict risk, which was defined as the probability that a private college or university will or will not fail in the near future. A series of logit tests of the Vulnerability Gauge found that the most robust and parsimonious model had an 86.3% prediction rate of financial risk when these two factors were used:

- Annual percentage change in Unrestricted Net Assets over five-years (for most private colleges, these assets represent the ready financial reserves that cover operational expenses);

- The total change in FTE (full-time enrollment) over five-years.

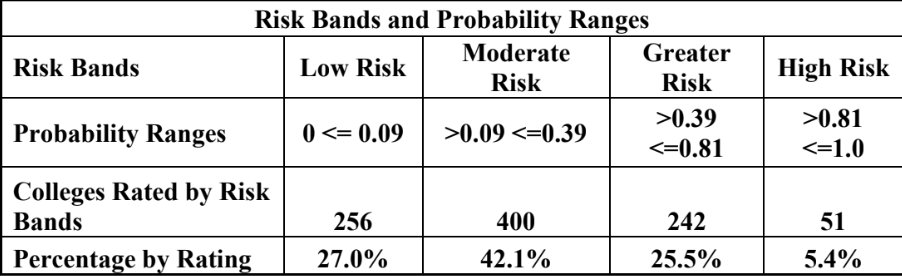

The probabilities for each member of the sample were then arrayed into four risk bands: low, moderate, greater, and high risk of financial failure as shown in Table 2. The risk bands indicate that the lower the probability, the lower the risk of closing and the higher the probability, the greater the risk of closing. The last two rows of Table 2 include the number and proportion of colleges in each risk band. The largest percentage were concentrated in the fewest number of colleges are in the high-risk band. Time will tell if the institutions in the greater risk band move to the high-risk band.

Table 2

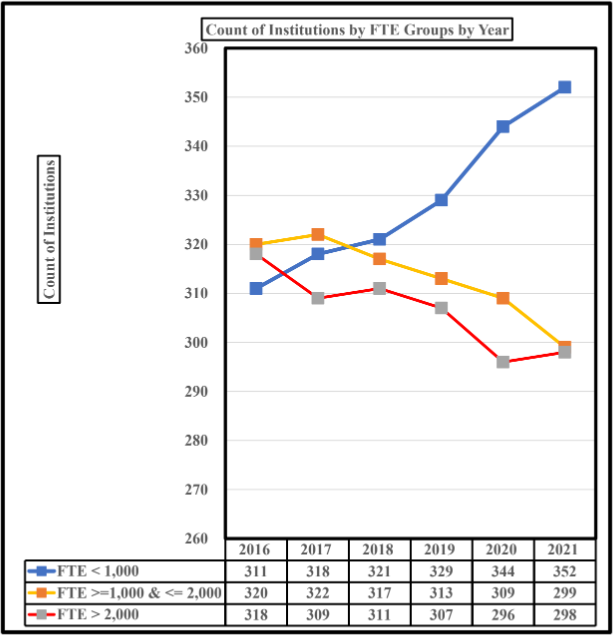

Chart 3 assigns colleges in the sample to three FTE groupings, FTE < 1,000; FTE >= 1,000 and

<= 2,000, and FTE > 2,000. The three graph lines show several interesting dynamics. Since 2016, the number of institutions with lest than 1,000 FTE have increased from 311 to 352, i.e., forty-one colleges. While both sets of colleges with enrollments between 1,000 to 2,000 FTEs and more than 2,000 FTE declined by forty-two colleges. This would appear to indicate that enrollment is having an unwelcome impact on those colleges that lost enrollment and move from

large or middle-sized colleges to smaller schools. Of course, lost enrollment more than likely leads to lots tuition revenue which begins to undermine Unrestricted Net Assets. The effect of lost enrollment will become more apparent as we delve into tuition discounts and unrestricted Net Assets.

Chart 3

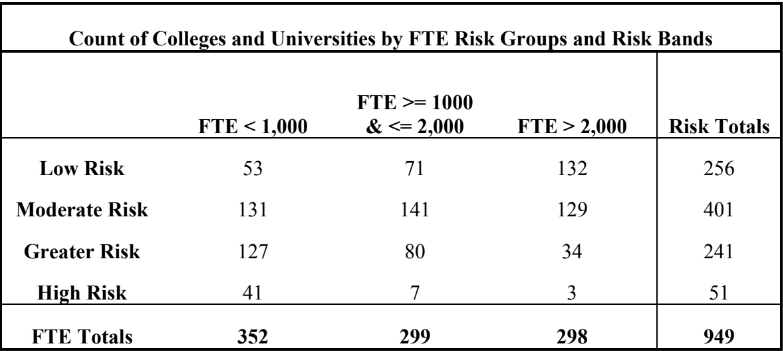

Table 3 and Chart 4 pull together the data from the Vulnerability Gauge variables. The table gives the counts by FTE groups and risk bands. This table indicates that

- Low risk institutions are concentrated in the FTE group with enrollments greater than 2,000 students. (132 colleges)

- Moderate risk institutions are closely spread across the three enrollments groups. (respectively from smallest to largest enrollment group: 131, 141, and 129 colleges)

- The FTE enrollment group with less than 1,000 has the largest number of colleges rated as greater risk. (respectively: (127 colleges)

- The less than 2,000 enrollments also have the largest number of institutions (41 colleges) rated as high risk.

Table 3

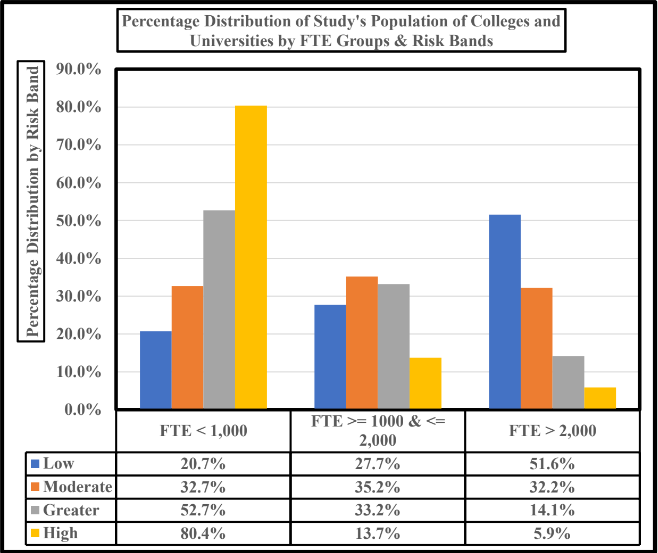

Chart 4 displays the percentage distributions for the four risk bands and risk bands. This chart clearly indicates that although the middle enrollment group has fewer colleges than the low enrollment group rated as greater risk, the percentage of the middle group is more than twice the number in the FTE group with more than 2,000 students. The near-term question is whether or not institutions rated as greater risk of failure will move into the high or moderate risk band.

Given these continuing declines in the: pool of prospective students, re-valuation of many degree majors by prospective students, coupled with the falling return-on-investment in a degree for graduates, it would not be surprising that risks will remain high and probably drive more colleges into the high-risk band.

Chart 4

Unresolved Issues

- Is the collapse of the value of Net Unrestricted Net Assets a quirk or a harbinger of more bad news for private colleges?

- Will those colleges rated as greater risk move to the high-risk category as enrollments and other factors diminish the pool of potential students?

- Will the fifty-one institutions rated as high risk in all three FTE enrollment groups move to extinction in the near-future?

- How much time do the institutions rated as high- risk have to devise a strategy and implement an operational plan to avoid closure?

- How much time do the institutions rated as greater risk have to avoid dropping into the high-risk category?

Final Comments

Higher education, in general, and private colleges and universities, in particular, as an industry faces a woeful future as slackening demand, rising costs, and excess supply of seats grinds down their financial stability. In most cases, catastrophic conditions did not suddenly appear. They have been present, more than likely, since student market demographics began their downhill slide at the start of this century. (See the Bloomberg essay, “The Economics of Small US Colleges Are Faltering”) [4]

The preceding discussion suggests the assumption that small colleges are the only institutions in danger is a false assumption. This finding of this study suggests that larger colleges can slide into the small college column. Also, the size assumption ignores that the second Vulnerability Gauge variable – Unrestricted Net Assets – that provides the pool of financial reserves to fund on-going operations of a college or university.

Two equations explicate the problem of financial stability for many private colleges and universities:

-

- Financial Stability Dynamic: shrinking student pool, rising costs, waning net unrestricted assets and small endowments

- Risk of Failure – Vulnerability Gauge Model: changes in net unrestricted assets and full- time-equivalent enrollments can increase or decrease the risk of failure.

Final comment: Time is of the essence; delaying action does not diminish the factors shaping financial risk of a college or university.

References

1 Marcus, Jon (April 26, 2024); “Colleges are now closing at a pace of one a week”; (Retrieved April 30, 2024); The Hechinger Report; Colleges are now closing at a pace of one a week. What happens to the students? – The Hechinger Report.

2 Querolo, Nic (December 13, 2023); “The Economics of Small US Colleges Are Faltering; (Retrieved April 30, 2024); Bloomberg; US Small Colleges Battered by High Costs, Enrollment Declines (bloomberg.com).

3 Querolo, Nic (December 13, 2023); “The Economics of Small US Colleges Are Faltering; (Retrieved April 30, 2024); Bloomberg; US Small Colleges Battered by High Costs, Enrollment Declines (bloomberg.com)

4 Querolo, Nic (December 13, 2023); “The Economics of Small US Colleges Are Faltering; (Retrieved April 30, 2024); Bloomberg; US Small Colleges Battered by High Costs, Enrollment Declines (bloomberg.com).