Economic equilibrium for a college or university is a state of long-term financial sustainability. Richard Cyert, late President of Carnegie Mellon University and a noted economist, originally developed the concept. This paper treats Economic/Financial Equilibrium as analogous to. Economic Equilibrium.

Economic/Financial Equilibrium Model

- Premises- Equilibrium:

- Is subject to the mission of the institution

- Should support the mission of the institution.

- Requires dynamic and positive states of positive financial change (net income and net cash must increase) in the short and long-term

- Financial changes must be large enough to offset inflation and to provide sufficient financial reserves when there are unexpected changes in markets, technology, and governmental regulations.

- Equilibrium Conditions1:

- There is sufficient quality and quantity of resources to fulfill the mission of an institution.

- Equilibrium maintains

- The purchasing power of its financial assets.

- Its facilities in satisfactory condition.

- Disequilibrium is a financial state when there are insufficient financial resources to maintain financial assets and to keep facilities in satisfactory condition.

- Difference between equilibrium and disequilibrium is the ‘equilibrium gap’.

- Reaching a state of financial equilibrium requires identifying and eliminating the causes of disequilibrium.

Disequilibrium usually does not occur overnight and most likely is due to long-term conditions that lead to the erosion of cash reserves, short-term loans, endowment principal, and plant value. When the financial condition of a college or university has so eroded that its cash and financial reserves have been seriously depleted, designing a strategic plan to achieve equilibrium is difficult.

Easy decisions, such as raising tuition or cutting expenses across the board, can be counterproductive if it pushes the college outside its competitive boundaries (that is, the set of colleges that compete to enroll the same students). As Richard Cyert noted,

“The trick of managing the contracting organization is to break the vicious circle which tends to lead to disintegration of the organization. Management must develop counter forces which will allow the organization to maintain viability.”2

In sum, boards of trustees must expect presidents and chief financial officers to clearly show that the college is currently in economic-financial equilibrium and will remain in equilibrium in the future. In addition, the board has a fiduciary responsibility to provide the president with the authority, subject to legal constraints, to take strategic and operational action to achieve economic/financial equilibrium.

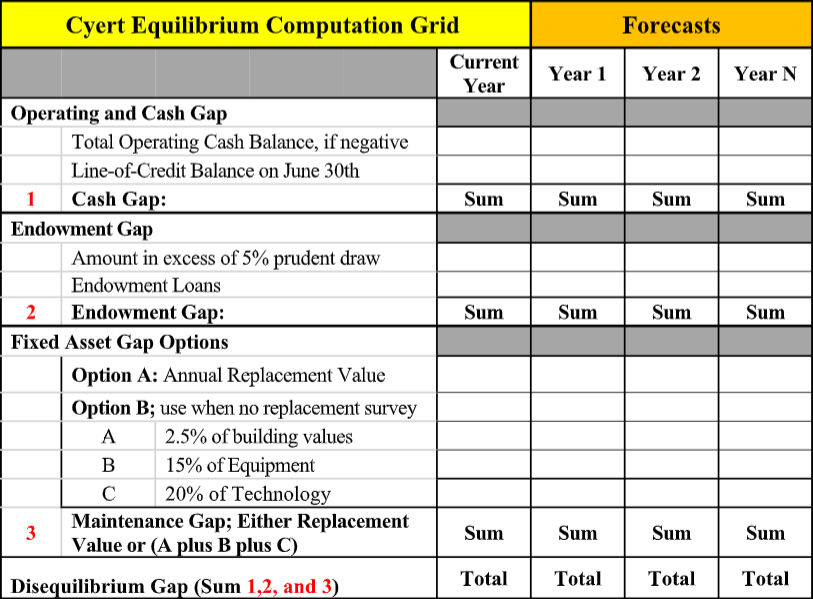

Template for Estimating the Disequilibrium Gap

The preceding template provides a means to identify the scale of disequilibrium. In addition, it allows the analysis to extend beyond the current year when contracts and other constraints impose costs leading to continuing disequilibrium in the future.

Common Strategies for Eliminating an Equilibrium Gap

- Enrollment, Recruitment, and Retention

- Enrollment, recruitment, and retention strategies requires analysis of current academic programs and the characteristics and goals of the prospective student market.

- Tuition discounts, since discount strategies have increased beyond their net cash value, any further increases in discounts must be carefully evaluated and carefully targeted as a competitive strategy.

- Marketing campaigns must precisely target prospective students with all forms of media and aggressively recruit students considering enrollment with a competitor.

- Retaining students is an imperative given the cost of replacing an attrited student. .

- Enrollment strategies should be guided this basic financial goal: net student revenue (net tuition plus net auxiliary revenue) must increase net cash.

- Gifts

Gift agreements should be written to reduce loan liabilities. At many private colleges, debt service makes-up a large portion of the Cyert Gap. Furthermore, the gift/advancement department should meet with prior donors and request permission to use their endowed gifts to reduce the pay down loans. Prior donors could be offered the bargain that the college would establish a scholarship in perpetuity in lieu of using the funds to pay down current loans.

- Endowments

If the size of the disequilibrium gap is so large that neither increases in enrollment nor cutting expenses will eliminate the gap, then the college should appeal to the state’s attorney general to allow a loan against the endowment.

Investment committees have conflicting preferences because they are expected to maximize endowment returns over the long term. A long-term investment strategy is valid if the gap is not massive. However, if cash deficits are so large that the

college faces the distinct possibility of closure; the investment committee must change its investment priorities to generate short-term cash flows.

- Auxiliaries

Too many colleges and universities ignore deficits produced by auxiliary operations. At a minimum, auxiliaries should cover their direct expenses plus related capital expenses. If the auxiliary cannot achieve this elementary financial goal, then the institution should outsource money losing auxiliary operations.

- Cost Controls

Cutting costs is essential for institutions at disequilibrium. Usually, a college will find that new revenue is insufficient to close an equilibrium gap. Under those circumstances, the college must evaluate every expenditure, be it, chief administrative positions, academic programs, student services, or third-party contracts. In some instances, the president may need to take over a chief administrative role, such as the provosts or chief academic officer roles, until the gap is eliminated.

- Refinance Debt

Too often, presidents and chief administrative officers waste their scarce time and the colleges scarce resources tinkering around the edges of the operations. If the college is heavily loaded with debt, a first priority should be to refinance the debt to reduce debt service expenses and to reduce collateralization that, in some cases, restricts the sale of college assets.

Summary

Economic/Financial equilibrium requires constant and regular monitoring of key activities by the board of trustees and the president. Equilibrium plans may require soul searching to determine if how the college can best serve the mission of the college and retain its financial viability.3

Final Points

- Economic Equilibrium is reached when an institution can fulfill its mission with adequate quantity and quality so that it retains its purchasing power while maintaining the conditions of its facilities and equipment so serve its students.

- The primary financial goal for tuition-driven private colleges should be to achieve a dynamic state of economic equilibrium that looks beyond the current year.

Economic/Financial equilibrium strategies must be continuously monitored and revised to accommodate changes in: the mission of the institution, student markets, academic programs, financial assumptions, and major changes in the economy or in financial markets.

References

1 Ruger, A., J. Canary, and S. Land.; (2006); “The President’s Role in Financial

Management” in A Handbook for Seminary Presidents; edited by G. Lewis and L.; William B. Erdman Publishing Company; Grand Rapids, Michigan.

2 Cyert, R. (July, August 1978); The Management of Universities of Constant or Decreasing Size; Public Administration Review; p. 345.

3 Townsley, M. (2002); The Small College Guide to Financial Health. Washington, DC: NACUBO; p. 180