Overview:

Private college leaders, especially presidents of small colleges, are tasked with maintaining the financial viability of their institution and avoiding strategic and management errors that threaten the continued financial viability of their institution. Shrewd presidents must recognize that tried and true strategies, policies, and programs that successfully generated reliable financial stability many now undermine the financial stability of their institution.

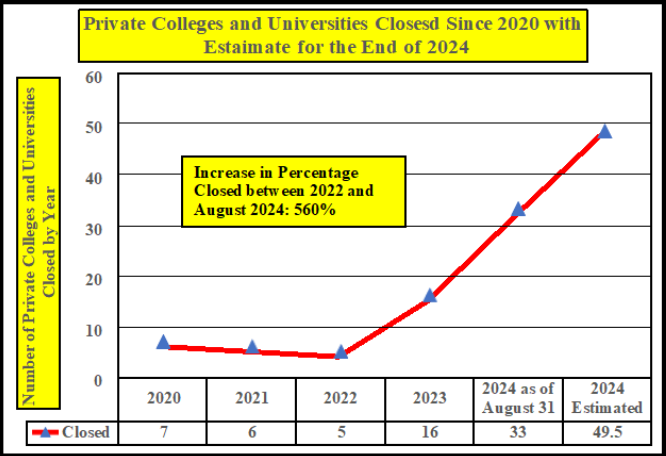

It is readily evident that private not-for-profit institutions are in severe straits with colleges as the pace of closings and mergers have increased between 2022 and 2024.

The purpose of this paper is to identify and comment on strategic and management decision that can place a private college at a high, risk of closing.

Strategies that Undermine Financial Viability

Until the student market collapsed since the turn of the century, there were a set of strategies that worked well to grow colleges. However, some of these strategies no longer work as expected due to shrinking student markets, changes in prospective student preferences for post-high school education, inflation, and fierce price competition as colleges struggle to enroll students. Below, is list of high-risk strategies with brief comments about their threat to financial viability.

Strategic Risk #1: Field of Dreams – Build Dorms and they shall come. Very expensive, high-risk decision is out of tune in a time of enrollment decline. Colleges that were late ‘to the field of dreams’ often find that their competition has fully exploited the potential of this strategy. Coming in late on massive dorm building in expectation of enrollment can lead to empty dorms and excessively high debt loads

Strategic Risk #2: Overcollateralization – this risk follows from Strategic Risk #1.

Overcollateralization happens when a financial agency believes that the college debt loads are excessively high and demand protection for their load by requiring the college to collateralize most or all college property. As a result, the college loses the flexibility in times of cash crisis to sell property. They will need the lender’s approval to sell, and they may not approve the sale because it increases the risk of the loan. Also, government regulations may limit the total risks held by the lender, and if the loans to the college are a large part of the lender’s loan portfolio, they could be at risk of governmental regulatory action.

Strategic Risk #3: Third-party contracts for enrollment – often this strategy follows from Strategic Risks #1 and #2. It is not uncommon that private colleges contract with third parties to recruit students. The catch is how payment for services is determined. The first issue is how is an enrolled student determined under the contract. Is a student counted if they remain a student through drop-add or through the end of the semester or fiscal year. In this instance, payment after drop-add is a very low bar given the volatility of students today. The second issue is the amount of payment per student for the third party. Is payment premised on a charge per tuition or tuition and fees. Obviously, the second method is much more expensive to the college. Lastly, what is the cost of the services? Since most third-party enrollment agencies charge a percentage, the scale of the percentage can have a significant effect on the amount of money that the college retains from student tuition. In some cases, according to information available to the author, some colleges are paying 25% of tuition and fees for new student enrollment. Strategic Risk #4 speaks to the threat to the college’s financial condition after the percentage owed on the agency is paid.

Strategic Risk #4: Tuition discounts that substantially exceed the national average – this risk often follows from Strategic Risks #1 through 3. According to the National Association of College and University Business Officials (NACUBO), The national average on ‘unfunded tuition discounts’ for 2023-24 was 56.1%.1 Assuming the average rate for 2023-24, the college would receive about forty-four cents in cash. Obviously, that is putting more pressure on the college to control expenses. If a college is paying a third- party twenty-five cents on a dollar of tuition and fee revenue, then they are getting only nineteen cents back in cash, which is a very paltry amount needed to cover direct expenses. Anecdotal evidence indicates that some colleges are offering ‘unfunded tuition discounts’ greater than 70%. For these latter colleges, they are only receiving thirty cents on a dollar of tuition. Colleges that offer 70% discounts and are paying 25% fees per new student are only receiving five cents on the dollar. No tuition-driven, private college can survive on this paltry return on a tuition dollar.

Special Comment on Strategic Risks for #1 through #4 – Cascading Effect:

Financial threats cascade for private colleges that came late to the ‘Field of Dreams’ strategy, are loaded with debt, are over-collateralized, use a third- party enrollment service, and pay a high fee for new students. It would be surprising that colleges facing this strategic risk cascade could survive very long. Survival for these colleges will depend on the scale of cash reserves and the ability of its president to convince the state attorney general to borrow large sums from its restricted endowment. A prudent attorney general as final arbiter of the college’s funds, might find it inappropriate to grant such a request.

Strategic Risk #5: Build Revenue by Adding Dozens of New Academic Programs. This is an old chestnut that was contained a wisp of wisdom when the student market was sufficiently fluid that students would come even if the new program was a very small niche in the market. However, too often, colleges now find that they have hired too many faculty, may have even tenured those faculty, yet only a handful of students are enrolled. In today’s financial environment, this strategy is a loser that probably does not come close to covering direct costs, let alone indirect costs.

Strategic Risk #6: Independent Entities. The board establishes independent entities that offer credit and degrees that are outside faculty oversight, the academic governance and presidential control. These entities may violate accrediting commission rules, which might find that because these entities lie outside the academic governance structure that the credits or degrees are not legitimate. Such finding by an accrediting commission could also have an adverse impact on Title IV financial aid funding by the US Department of Education.

Strategic Risk #7: Trade Enrollment for Academic Standards. This problem dates back to the late sixties when colleges and faculty began to dilute the curriculum to accommodate the interests of students in response to student protests. David Reisman and Christopher Jencks were the first to address this issue in their book The Academic Revolution2

Strategic Risk #8: Failing to Perform Due Diligence. Too often college boards and president do not carefully read a costly and/or long-term contract nor thoroughly analyze the financial impact on the finances of the institution. The preceding example about enrollment recruitment agencies is a good example. Heavy financial burdens can also arise from bond covenants or loan conditions, or even faculty and staff contracts. The failure of due diligence can deplete financial reserves and constrain the strategic and operational options in response to a crisis.

Cautionary Note – Leadership:

A private college facing an impending financial crisis needs a president that: is assertive, focuses on action to stem the crisis, works with the faculty with the understanding that they are in an advisory role and not a decision role, and works closely with board to press forward with change. During a financial crisis, some presidents remain passive agents of change that are dependent upon the vagaries of issues thrown their way by a self-interested and opportunistic academic governance system. These presidents will fail to gain the momentum needed to arrest the impending financial crisis.

Policies and Practices Risks (P & P) that Undermine Financial Viability

Although misbegotten strategies have the potential of dealing a fatal blow to the financial viability of a college, ill-conceived policies and procedures can also foster a financial crisis and confound actions to stem the crisis. This section will describe several of the more prominent policies and practices that need to be resolved during a financial crisis.

P & P #1: Excessive rates of tenure and long-term contracts imposes long-term costs that are difficult to reduce, and they reduce the flexibility of the board and president to change the mission and structure of the academic programs.

P & P #2: Course schedules that do not allow students to complete their degree within a four-year cycle. This leads to an excessive number of independent studies as faculty arrange courses so that students can complete course requirements. This is a very inefficient practice because it reduces class size to 1 and adds the costs of the independent study to operations.

P & P #3: Released time to staff and faculty increases costs without generating significant benefit to the institution and to its student

P & P #4: Failure to Pay for the best experienced key people

P & P #5: Adding new faculty, staff, or administrators, when existing employees do not carry out their duties, because it is easier to add personnel than to fire underperforming employees.

P & P #6: Hiring new persons whenever staff or faculty or administrators that the workload has increased without evaluating the assertion. Too often the additions, do not necessarily improve the delivery of services but diminish service output to the detriment of students

P & P #7: Excessive effort is spent on generating and acquiring grants that distort the mission and operations of the college and do not sufficiently contribute t its financial stability.

P & P #8: Providing assistants to do menial servant work for faculty and administrators, ex. copy papers, pickup mail, get supplies, and type papers in an era of personal computers.

P & P #9: Failing to use legal counsel to review board policies, contracts, major human resource issues, governmental relationships, and other matters that could result in legal action.

P & P #10: Not following policies, procedures, and contractual handbooks when introducing change or responding to problems.

P & P #10: Not regularly reviewing board by-laws, college policies and practices, faculty and student handbooks, and other documents that govern decisions.

P & P #11: Irregularly revieing financial reports of the college and by department and not receiving estimated end-of-the-year budget reports during the year.

P & P #12: Perfunctorily signing purchase orders and staff reimbursement reports without determining if the purchase fits the goals and mission of the college and the reimbursements are justified given the policy of the college.

Summary

The preceding list of Strategic and Policies and Practices Risks is not a comprehensive compilation of the risks to a college in financial crisis. The lists are meant to inform presidents and boards so that they can improve their chance of successfully responding to financial crisis.

The keys to a successful response to an impending financial crisis are:

- Timely recognition of an impending financial crisis by the Board of Trustees and President

- Understanding the causes of the crisis

- Presidents who recognize the crisis and can expeditiously formulate responses and bring the community to action

- Support of the President by the Board of Trustees

- Taking action and not dithering in discussion.

- Using a financial crisis team, in which the best persons in their respective field are hired. The team would include:

- Chief Academic Officer (CAO) – in addition to the faculty, must know how all the department to this officer operate and should be able to step in and do the work.

- A president, who has worked with the faculty and even worked with departments reporting to the CAO should be able to run this position. This would only occur if the CAO position is empty or lacks the skills or refrains from making the necessary and difficult decisions during a crisis.

- Chief Enrollment Officer (CEO) – this person should show experience in designing an effective recruiting students and marketing the college. The CEO should know how to use all forms of communications to reach the student market and track them through enrollment and the first year of study.

- Chief Financial Officer – this position should be filled by a certified public accountant (CPA) who has directly supervised business and financial operations. The CFO should also have experience managing current debt and refinancing debt packages, managing operational and capital contracts, and preparing regular budget and financial reports for the president, the Board and the crisis team.

- Chief Human Resources Officer – this position is critical because of the likelihood that the transformation will result in large number of dismissals, revision of pay schedules, or redesign of work policies and procedures. This person should proficient in governmental employee laws and regulations in addition to the employee policies and procedures of the college

References

1 Scwartz, Natalie (May 22, 2024); “Tuition discounts at private nonprofit colleges hit new high, study finds”; Higher Ed Dive; Tuition discounts at private nonprofit colleges reach new highs, study finds | Higher Ed Dive.

2 Reisman, David and Christopher Jencks (1968); The Academic Revolution; Doubleday; New York.