by Michael K. Townsley | May 3, 2025 | Presidential Leadership, Uncategorized

Push and Pull-on Authority between President and Board of Trustees in a Financial Crisis

Presidents and boards of trustees often respond to a financial crisis with a destructive contest in which a board resists the president for greater authority. The president takes the lead because they believe that an effective response cannot take place unless they have more authority to make changes at all levels of the college. The board pulls back from the president’s request because they fears that the college will lose its historic identity and be unable to fulfill its mission.

Here are examples of the push-pull over authority between presidents and boards of trustees.

- The most obtuse case in the push-pull of authority is where the board does not include in its by-laws that it retains final authority over all decisions.

- A particularly annoying case for presidents is when a board prior to the crisis relinquishes its authority over academic programs and decisions on hiring, reassigning, and dismissing members of the faculty.

- For the president, the most troubling authority transfer to the faculty is when the board permits the faculty to determine the conditions for tenure, the number of tenure positions, and the procedures for reviewing tenure.

- Another short-sighted decision by a board is when they expand board membership to include members of the faculty. The ostensible reason given in some instances is to improve communications between the board and the faculty. Granting membership to the faculty for this reason is a clear statement that they do not trust the president. Problems with placing faculty on the board include:

- Faculty members are self-interested at a time when the board needs to be disinterested in the outcomes of its decisions.

- The faculty become privy to personnel action that may affect a member of a colleague.

- The faculty members could carry sensitive information about strategic options and personnel changes back to colleagues. Under these circumstances, a cautious board could forfeit open discussion.

- Even more debilitating is when a general uproar in the college results in leaks to the press. The danger with leaks to the press is that governmental agencies and accrediting bodies may become involved prematurely in options that are only under consideration.

- Disagreement between the board and president over the degree of authority to grant the president during a financial crisis may not be resolvable. Nevertheless, the board’s decision on granting additional authority can be critical, if the president has a credible strategy to end the financial crisis. Not granting the necessary authority can doom the possibility of stemming a financial crisis. In a deep financial crisis, time is of the essence.

by Michael K. Townsley | Feb 22, 2025 | News 2025

David Reisman, a renowned commentator on higher education, noted fifty years ago that colleges set revenue to the level of their revenue. A corollary is that colleges add fixed costs to the level of large and predictable sources of revenue, such as federal revenue for indirect costs for administering federal grants. Cutting fixed costs is always painful.

The federal announcement that indirect cost support will be cut to 15% of grant revenue will put tremendous pressure on research universities and any college receiving large sums from indirect cost support. These college will face the following quandaries: raise tuition, cut costs, or do both. Since today’s market is no longer a sellers’ market, expect significant cuts to expenses. These cuts will typically mean dismissing employees and upsetting the operations of these institutions.

by Michael K. Townsley | Feb 22, 2025 | Financial Metrics

Here are four reasons why colleges cost so much and why it is difficult to lower tuition prices.

- You might recall David Reisman’s fifty-year old rule that colleges usually increase revenue to the level of their expenses. In other words, it has been easier to increase expenses and support the needs of the college than to limit expense increases and hold tuition prices steady.

- Because there are so many colleges, especially small colleges, there is little, if any, economy of scale to spread the costs of operation.

- There is little incentive to merge colleges because unlike a business no one a college gains a monetary benefit from a merger. In business, a benefit generally takes the form of a large cash payment to the chief executive.

- Accreditors and government agencies make it difficult to merge colleges or sell one college to another unless the one of the colleges is in dire financial distress. Under that condition, the college in distress has little of value such as a large enrollment base to offer another college.

by Michael K. Townsley | Feb 22, 2025 | News 2025

Colleges and universities are in a high state of anxiety and confusion about the Federal government’s announcement that DEI violates civil rights laws. Their greatest concern is what to do with accreditation mandates that colleges have DEI policies and programs. How can a college respond to a federal declaration Accreditation commissions across the country need to inform their member college about the plans to deal with the federal declaration on DEI. Since the accreditation mandates are usually part of commission mandates, they will have to do more than sent out a statement. Each commission will need to consult with their attorneys and conduct commission meetings to determine what action to take.

by Michael K. Townsley | Feb 13, 2025 | Financial Strategy and Operations

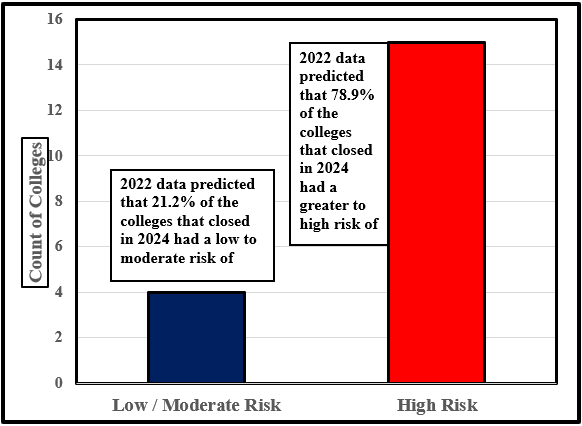

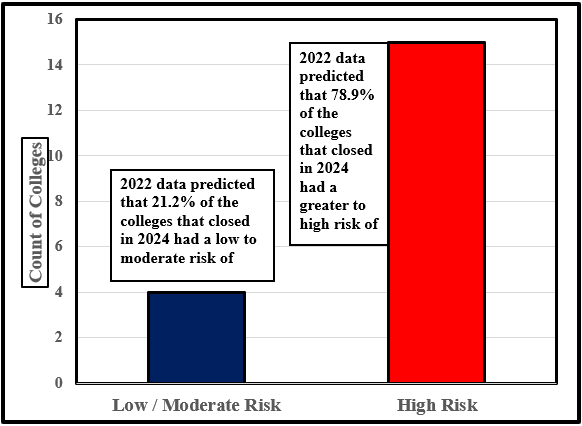

A recent article in Deep Thoughts on Higher Education listed thirty colleges and universities that closed in 2024. We applied our Vulnerability Gauge Model to the list to assess their financial risk. Only nineteen of the private four-year colleges were used in the analysis because data was missing for eleven colleges, one was a community college, one was a public university branch, and one was a branch of a very large private university.

Chart: Comparison of Private Colleges with a High Risk of Closing in 2022 Compared to the Actual Number that closed in 2024

The preceding chart shows that for the nineteen private colleges tested using the data ending in 2022, four or 21.2% of the colleges were identified as having a low or moderate risk of closing and fifteen or 78.9% of the colleges had a high risk of closing within three years.

Because closings skyrocketed between 2022 and 2024, the analysis suggests that presidents and boards of trustees should quickly arrange an estimate of their college’s financial risk of closing. This step should also be taken annually.

The Vulnerability Gauge Model is an inexpensive and quick measure of financial risk. To purchase, click: https://buy.stripe.com/8wMaFHcgofhT1DaeUV.

If the model predicts that your college has a high risk of financial failure, you should take immediate steps to lower risk! We’re here if you need our help.