by Michael K. Townsley | Sep 28, 2025 | Financial Strategy and Operations

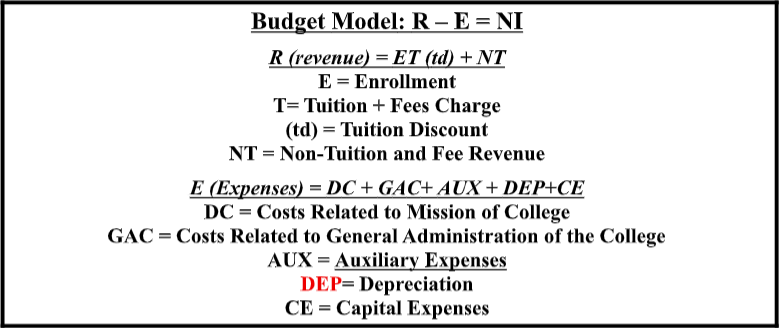

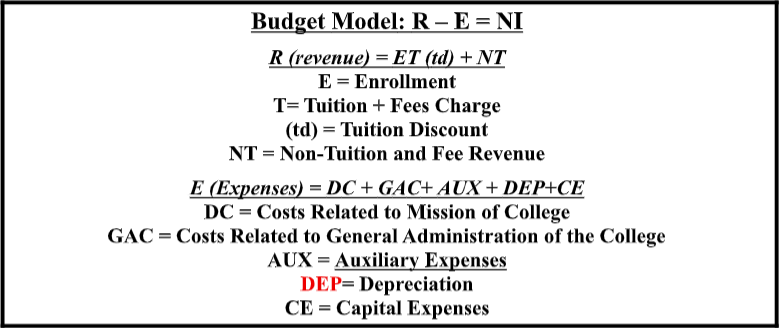

This simple budget equation captures the major factors that drive the on-going financial condition at most private colleges and universities. The conundrum for the president, chief financial officers, and other chief administrators is the degree to which they do or do not have control of the budget variables.

Budget Model

The budget model is a straightforward linear equation with easily recognizable variables that drive the outcome net income. However, the values that feed the variables make the model idiosyncratic for each institution. In the past, the model was a finely tuned instrument intended to set tuition that students can afford, fund its operations, and maintain its solvency. Owing to the large number of closed or merged colleges and cancelled academic programs, the budget that is based on the current structure, policies, and academic programs is having greater difficulty finding: a tuition price that works for the student and college, funding its operations, and maintaining solvency.

Budget Model Balancing Mechanism: Revenue, Expenses, and Net Income

The budget model depicts the balance as changes take place among– revenue, expenses, and net income. The following table lays out typical changes in revenue expenses, and net income.

|

Revenue

|

Expense Decisions

|

Net Income

|

|

If revenue increases

|

Expenses could increase

|

Net could decrease, remain stable, or go down.

|

|

If revenue decreases

|

Expenses could increase

|

Net would go down

|

|

If revenue remains the same

|

Expenses could remain the same

|

Net could remain the same

|

|

If revenue remains the same

|

Expenses could increase

|

Net would go down

|

Because private colleges are dealing with significant threats to their cash reserves, the budget model variables and values should be construed to estimate the impact of the budget on cash reserves. Therefore, depreciation would not be included in the model because depreciation is a non-cash transaction. As a result, net Income should be equivalent to positive or negative changes to cash reserves. Obviously, this caveat does not account for non-cash variables or values such as, depreciation. While the primary goal of the budget model is to estimate the cash effect of budget decisions, it would be prudent for the college to test the budget impact on the audit version of net income by including depreciation.

Richard Cyert and the Budget Model

Before the discussion on the budget equation begins in earnest, let us consider what Richard Cyert, a leading organizational theorist, and the late president of Carnegie-Mellon University, developed the concept of Economic Equilibrium, which is a state of long-term financial sustainability that rests on the following principles.

- There is sufficient quality and quantity of resources to fulfill the mission of an institution, and

- The organization maintains:

- The purchasing power of its financial assets.

- Its facilities in satisfactory condition.

Cyert’s theory posits that equilibrium depends on continuously increasing cash flows from operations to maintain the purchasing power of its operating financial assets and sufficient capital gifts to keep its facilities in satisfactory condition. Colleges need a dynamic state of economic equilibrium in which financial resources grow to avoid a state of disequilibrium; i.e. budgetary outcomes that puts a private college a risk of slipping into insolvency. An institution can no longer assume that positive but small changes in net income and financial assets are sufficient to stave off disequilibrium.

When an institution’s financial condition has eroded to the point where its cash and financial reserves have been seriously depleted, developing a strategic plan to achieve a dynamic state of equilibrium is difficult. Easy decisions, such as raising tuition or simply cutting expenses across the board, can be counterproductive if it pushes the college outside its competitive boundaries. As Richard Cyert noted, “the trick of managing the contracting organization is to break the vicious circle which tends to lead to disintegration of the organization. Management must develop counter forces which will allow the organization to maintain viability.”[4]

Cyert’s proposition about economic equilibrium implies that it is imperative for colleges to retune their budget model to maintain or regain equilibrium. Keep these comments in mind, as the revenue, expense, and net income factors that make-up the model are examined.

To reiterate, the purpose of this paper is to gain a better about the budget equation and the factors that drive the equation.

Revenue Factors

Revenue provides the funds to support operational costs to carry out the mission of the college. The revenue factors discussed below include: enrollment, tuition and fees, tuition discount, and non-tuition revenue

Enrollment (E)

Enrollment, as anyone who works in budget planning well knows, is not a simple sum of all the students in the college. The nuances are myriad. Here are several aspects of enrollment that need to be considered.

- Recalling that this is a budget exercise, enrollment is subdivided based on the price charged for a particular segment of enrollment. For example:

- Undergraduate students typically are charged a different tuition than graduate students,

- Part-time students are either charged at a fixed rate depending on how part-time status is defined; or on sliding rate depending on the credits taken;

- On-site classes may have a different rate than on-line classes;

- The price-enrollment categories are endless. Obviously, any degree of complexity in the price-enrollment requires precision in accounting for the different enrollments so that enrollment and accounting records can be reconciled.

- Besides the price-enrollment dynamic, enrollment is subject to student demand for the college, graduate outcomes, its programs, reputation, location, and schedules. Student preferences have changed dramatically since the COVID pandemic and changes by employers in the type of skills that they seek from college graduates. Now, a growing proportion of prospective and enrolled students want a degree that directly related to their probability of finding employment that provides both a loveable wage and cover the costs of living and debt service for their education.

- Moreover, prospective students seek more information from social media about colleges and their outcomes. As a result, the old enrollment strategy of traveling to high schools to find students is now a minor tactic compared to current dynamic and sophisticated student marketing campaigns.

- The Enrollment Cliff has wrecked the old new student strategy of needing just a few more to make budget and sustain financial operations. Because of the Cliff private colleges now live in a state of anxiety because they cannot find students to match current enrollment let alone keep pace with costs by enrolling additional students to

Tuition and Fee Charges (T)

- Economics of tuition and fee charges – they are the price that mediates student market demand and the supply of colleges programs. Because of the demographic cliff combined with too many colleges offering similar programs, colleges have lost their capacity to control tuition and fees. Under these conditions, price – tuition and fees – should fall. Since most of the discussion about tuition is about the posted price, real price declines have been missed. For years, analysts have pointed out that tuition discounts reduce the posted price and over the past several years, real tuition has been falling dramatically as tuition discounts increase. (see the later discussion on tuition discounts to understand the impact of rising discounts on a college’s financial stability).

- Howard Bowen. in the 1980s expressed skepticism about the apparent business principle in which expenses drove tuition and fees. The implication of their skepticism is that at some point private colleges and universities would lose that luxury in which tuition and fees could be pressed forward without any consequences. It is now evident given the tight constraints that college face when adjusting tuition charges that their incredulity was justified.

- Colleges have been able to game tuition constraints by increasing fee rate and by adding new fees. This game will not work well during a time of pinched student financial resources.

- Colleges no longer face an ignorant student market with few choices, parents and students have become savvy price negotiators, which has transferred pricing power from the institution to the student.

Tuition Discount (td)

- A tuition discount is an unfunded institutional scholarship that reduces the price of tuition. Because the scholarship is unfunded, the college does not receive offsetting cash from endowed funds as it would with a funded scholarship or a government grant. This means that as unfunded tuition discounts increase, cash decreases and the capacity of the college to cover its existing cost structure is diminished, which increases its risk of failure.

- The financial crunch, in which colleges try to maintain economic equilibrium during a period of severe decline in student markets, change in student preferences away from existing majors, and, as will be noted below, decisive cuts in federal funds is putting greater pressure on colleges to increase tuition discounts. The problem is, as indicated above, that every uptick in tuition discounts cuts into the cash needed to support operations and throws colleges into economic disequilibrium.

Non-Tuition and Fee Revenue (NT)

- The sources of Non-Tuition and Fee cover grants, gifts, endowment draws, auxiliary revenue, and any other revenue not related to tuition. Just a note on endowment draws, since median draws is about 5% of the endowment, a $1 draw $20 of endowment. This relationship requires a large endowment to have any real impact on the budget. Because most private colleges do not have large enough endowments or the prospects of substantially increasing their endowments, this source of revenue remains a minor player during a time of financial crisis.

Further Notes on Revenue in the Budget Model

- For the average private college, enrollment driven revenue is the primary source of funds that drive the outcomes of the budget model.

- For most new and continuing students, the price of enrollment is made palatable by federal aid, funded institutional scholarships, and unfunded scholarships. Any significant negative changes in federal and funded scholarships can adversely affect a student’s decision to enroll. In addition, when colleges try to minimize the effect of shrinking federal aid or strong price competition by increasing tuition discounts, too often the financial viability of the college is threatened.

Expenses Factors

Expense factors delineate the way in the categories in which funds are allocated to carry out the mission of the college. The expense factors discussed below are: direct costs, general administrative costs, depreciation, and capital expenses.

Direct Costs (DC)

Direct costs include: instruction; student services, academic support, and other costs associated with delivering educational services to students. NB. This discussion does not include research because private colleges with large research budgets usually have a different budget dynamic.

General Administrative Costs (GAC)

General administrative costs encompass: institutional administration (president’s office, insurance, utilities, and like costs that relate to all segments of the college), building and grounds, and other general administrative costs that are included in the audit under institutional expenses.

Auxiliary Costs (AUX)

Auxiliary costs cover the cost of running: residence halls, food stores, book stores, and any other peripheral operation that is deemed by the college as auxiliary to the main purpose of the college and generates auxiliary income.

Depreciation (DEP)

Depreciation is the annual accounting charge against net physical assets, such as, buildings, grounds, and equipment. Depreciation should not be included when estimating cash generated from net income.

Capital Expenses (CE)

Capital expenses usually involve interest payments on debt.

Notes on Expenses

Multiple conditions usually constrain the flexibility of budget planners in what they can easily cut during a financial crisis: tenure, employment contracts with long-term commitments, debt, location of classrooms, utilities, contracts with third parties, zoning restrictions on the use of property, and restrictions on the use of endowment funds, engineering limits on buildings. Each college often has unique conditions which limit a college’s flexibility during a financial crisis.

Net Income (NI)

Net income is simply what remains after expenses are deducted from revenue. If the goal of the college is to reach Cyert’s Economic Equilibrium, then the college must focus on the Net Income in terms of the cash that it produces.

The Balancing Act

- Typically, when a college intends to resolve financial stress by using the Cyert Criteria of Economic Equilibrium, it must continuously Net Income shows positive cash flow. Then, the rebuild cash reserves and any loans from the endowment within two to three years? If the budget model falls short in resolving financial distress, then the college must work harder to reduce costs, find new sources of income, and convert assets to cash.

- Debt covenants, such as, the requirement not to produce a string of deficits, can force a college to make large expense cuts that would dimmish the college’s capacity to serve its mission.

- Debt collateralization occurs when a college grants rights to property to a debt holder to secure a loan. During a financial crisis, collateralized property may not be sold without the debtholders’ permission. Moreover, even if they can sell the property, the debtholder could tell the college that the proceeds from the sale go toward reduction of debt principal.

–

-

↑

by Michael K. Townsley | Aug 30, 2025 | Presidential Leadership, Uncategorized

by Michael Townsley & James Gaddy

As small colleges across the country face mounting challenges—declining enrollment, financial instability, and increased operational complexity—many are rethinking what effective leadership looks like. Between 2010 and 2021, college enrollment in the U.S. dropped by approximately 15%, placing pressure on institutional budgets and prompting some colleges to downsize, merge, or close altogether. These realities demand a shift away from the traditional notion of the college president as a purely academic figurehead. Today’s leaders must be as fluent in financial strategy and organizational management as they are in institutional mission.

This does not mean that academic credentials are irrelevant. On the contrary, a terminal degree remains essential for credibility in the academic community and for understanding the core values of higher education. Although the traditional career ladder for an aspiring college president remains the traditional path to rise up the academic ladder to become a president, it may be time to consider another path because, in these parlous times, the traditional path may not provide a president with the skills needed to manage a complex college structure.

Effective presidential leadership, as colleges pass through a long-term period of enrollment and financial distress, requires decisiveness and adaptability, when they make decisions. Decisiveness and adaptability depend on an aspiring president developing a deep understanding of the policies, procedures, and daily operations that drives a college. Yet, they still need to appreciate and respect academic culture. A terminal degree in academic discipline helps reinforce this understanding and ensures that leaders can engage credibly with faculty, accreditation bodies, and external academic stakeholders. However, as Christensen argues, many of the most persistent leadership failures have come not from a lack of academic knowledge, but from weak financial oversight and poor institutional strategy.

This paper proposes a new career path which resolves the Christiansen dilemma of leadership and failure. The new path asserts that an aspiring president should spend time intensively working in each operating department so that they can become proficient in their policies, procedures, coordinating relationships, operational budgets, operational constraints and potential efficiencies.

Many readers may be put off by a new path for aspiring presidents that is common approach to developing managers in business. It is imperative that presidents know the ‘nuts and bolts’ of their college as these factors drive their colleges to the brink: demographics, new federal funding regulations, higher endowment taxes, reluctance of banks to continue to increase short-term cash loans, and economic forces like aggressive price competition, excess supply of classroom seats, inflexible fixed costs, auxiliary services that no longer pay for operational and capital costs. When a president understands the details of their operation, they will also know, how to reorganize the college and respond to opportunities in the market.

The alternative career path, which the author believes will develop strong presidents with the foresight and management skills to accomplish the mission of a college, is laid out below.

Givens

- The model assumes that typical degrees will still be needed as the aspirant climbs the ladder to a presidency, such as,

- a doctorate degree – Ph.D. or Professional or DBA;

- Small colleges the starting point for most new presidents will continue to face severe financial pressures requiring presidents who have the skills to understand all segments of the operations of a college.

- Colleges, in particular, private colleges will need presidents who understand the operations of a college, so that they can make reasoned management choices based on their experience as they prepare for a college presidency.

Alternate Career Path

- Rather than using the traditional academic path to prepare for a college presidency, the aspirant will follow a path in which they are assigned to each significant operational department.

- Alternate Career Path will involve learning the skills, policies, and procedures of these departments: admissions, registrar, financial aid, bursar, enrollment management, academic affairs, IT, academic services, student affairs, finance, and building and grounds.

- Goal of the Alternate Career Path is to develop aspirants who understand the deep operations of the college its markets, strengths, weaknesses, opportunities and threats, along with the vision to develop strategies and the capability to identify problems that need to be fixed.

- This path will require the assistance of the president and senior administrators to schedule work. As assignment to a department should take at least a month, and in some cases, may take a semester.

- Specific skills to be learned in each department (this is a sample of skills):

- Admissions – enrolling students, preparing class schedules, collecting transcripts and other documents, preparing a student portfolio, and passing the student onto the registrar and financial aid

- Registrar – record enrollment;

- Financial Aid – preparing an aid package for a student to include: governmental aid and loans, institutional aid copies of the enrollment and financial aid package to the registrar bursar.

- Bursar – recording new and continuing student method of payment and providing the student with a statement of their account with any balances owed, and the dates for payment.

- Enrollment Management – reviewing past data to estimate enrollment by major and degree level, estimate sources of financial aid, and identify target markets for enrollments. Design marketing campaigns for target markets by: reviewing past performance, sources of data on potential students, means of reaching the students, costs of the campaign, and the campaign schedule. Establish goals by major and degree level and average cost of enrolling student. Submit enrollment budgets to the business office and to the president.

- Academic Affairs – work on the development of class schedules, assignment of faculty and classrooms; request and review syllabi, prepare lists of instructional materials to be ordered and list of books for the bookstore; notify building and grounds of class schedules. As an exercise, design new academic processes to improve the efficiency and lower the costs of academic operations.

- IT – learn the IT and communications network structure of the college and shadow IT personnel as they work with administrative and academic networks and systems. Learn how to pull down IT data and produce spreadsheet reports.

- Academic Services – work in the library and other academic support services to see how they organize and carry-out their work.

- Student Services – this training set could involve a variety of services such as: student counseling, residence halls, food services, nursing services, and athletics. Time should be spent in each section to learn how they plan, deliver services, and their challenges.

- Finance – training in finance is an imperative because a president must understand: the structure of the accounting system, the audit schedules, monitoring expenses; generating financial performance reports, and scheduling budget planning and analyzing proposed budgets, and preparing regular and end-of-year financial reports. By the end of training in finance, the aspirant should be able to read and understand budget, financial, and audit reports.

- Building and Grounds – this is an interesting center that an aspirant should understand in the following detail: debt structure for the college, depreciation allocations, space allocation for instruction, support services, and offices; electrical and other utilities, building ages and physical condition, deferred maintenance, custodial services, and security services.

- Additional Notes:

- Train yourself to analyze operational problems and create solutions;

- This path will require a considerable amount of time to complete, but, at the end of the training, the aspirant will have developed the skills to be a valuable leader of a college.

Estimated Time Commitment for the Alternate Career Path

An aspiring president should plan to spend at least academic and financial cycle in each major department. The total time commitment could take 36 months. However, the financial cycle could require two three-month cycles for budget development and for financial/business training. Obviously, this is not a trivial amount of time, but the aspirant needs to approach the time commitment as an opportunity to build managerial skills that will outrank other competitors for a presidential opening.

Conclusion: A More Effective Leadership Model

Small colleges are at a crossroads. It has become obvious in the past two years, that colleges are failing because many presidents did not understand the financial and operational fragility of their institutions. There is no evidence that the forces that have adversely shaped colleges will change. For instance, the demographic cliff will not end anytime soon, new federal regulations will make it more difficult enrolling and keeping students, higher taxes on endowments will reduce payouts, cuts in indirect cost recovery will further undermine the operational capacity of research institutions. In other words, college and university presidents will no longer be able to depend on traditional sources of funding, or moving chess pieces in an ambiguous decision game, or finding new and richer donors to keep up appearances

To survive and thrive, they must move beyond outdated leadership models that prioritize academic prestige over operational readiness. This isn’t a rejection of academic values; rather, it’s a realignment of leadership roles to meet today’s complex institutional needs.

Presidents must be selected for their ability to manage change, secure resources, and lead strategically—while partnering with provosts and faculty to uphold academic excellence. A balanced approach—business-minded presidential leadership paired with empowered academic governance—offers the best path forward for small colleges seeking long-term sustainability.

Some may see this alternative path as being too much like a like a trade guild apprenticeship. Yet, the apprentice-master relationship is an interesting trope in education because it is how professors were certified as masters to join the professoriate. Nevertheless, colleges will only survive, if presidents manage their college like a business and understand every operation in their institutions. It has become obvious in the past two years, that colleges are failing because their presidents did not understand how financial and operationally fragile their institutions were. There is no evidence that one of the main factors, the demographic cliff, in the demise of these colleges is going to end anytime soon. New federal regulations will make finding and keeping students even more challenging. Furthermore, higher taxes on endowments and cuts in indirect cost recovery, even the strongest research universities will face greater risks to maintain credible research programs. In other words, college and university presidents can depend on traditional assumptions about revenue, or moving chess pieces in an ambiguous decision game, or finding new and richer donors to keep up appearances. In conclusion, private colleges and universities must have presidents who have developed strong managerial skills if they want to survive and strengthen their financial reserves and their position in the student market.

In conclusion, colleges and universities must take on the hard discipline of management if they want to do more than survive on a meager financial margin with a piece-meal changes to operation while watching cash reserves dwindle to nothing.

Go to Doors to Academia for More Posts on the

Current State of Higher Education

by Michael K. Townsley | Aug 16, 2025 | Presidential Leadership

By Michael Townsley and Jack Corby

In higher education today, boards of trustees and presidents must know if their college is doing what it claims to be doing in its mission statement and its curriculum. Financial operations use an auditor to determine if the college is following standard accounting procedures and accurately reporting its financial position. However, the academic and operational programs do not have anyone comparable to a financial auditor to assess their administrative operations, and their academic programs. When colleges do not have a third party assigned to assess their administrative operations and academic programs, the college may falsely assume that the absence of complaints means that all is well with its administration and instructional program.

Colleges and universities can no longer afford the luxury that no news is good news because inefficiencies add unsustainable costs to the college, while ineffective delivery of academic services leads to graduates who are unhappy with their degrees. For instance, recent articles, for example, by Forbes magazine report that many graduates are finding that they do not have the practical skills for the job and the market. If a college wants to survive the crushing demands of the demographic cliff, the loss of federal funds, and the changing preference of potential students for a degree, it cannot assume that all is well. They must test operations and academic programs to ensure that they are efficiently and effectively delivering their services.

This brief paper has suggested that the boards of trustees and presidents should fund a performance analyst to ensure that academic and administrative operations are efficient and effective in delivering on its mission and curriculum. The following outlines the role of the Performance Analyst:

Performance Analyst: reports directly to the president and has full authority to access data, review policies and procedures, examine the efficiency of operations, and make recommendations to improve performance

Duties (this is only a partial list, and it could differ by institution):

- Analyze policies, processes, and outputs for operational and academic departments;

- Analyze the policies, processes, and relationships between IT and academic departments;

- Analyze the interface between: administrative departments, academic, plant, IT, finance, athletic, and other substantive departments;

- Analyze the relationship between governance structures, for instance: board and administration, board and faculty, administration and academic governance, and other governance structures in the institution;

- Analyze the interface between the college and external parties with which the college has a quasi-legal or contractual relationship;

- Analyze the college’s student flow from marketing to admissions, to registration, to class assignments, to bookstore, to courses, to graduation, to alumni affairs;

- Analyze college performance in terms of the effectiveness and efficiency of skill development by major;

- Annual Reports on enrollment, graduates, retention, finding jobs post-graduation, moving on to graduate degrees or professional degrees, cost per student credit hour, net revenue for revenue-generating departments, and efficiency of the allocation of assets to instruction and operations.

- Provide the president with detailed recommendations on changes to improve efficiency and effectiveness for each area studied.

In summary, the main goal of the performance analyst is to ensure the effectiveness and efficiency of the institution and to suggest changes that improve effective and efficient operations.